Optimism has flooded the global markets. We have witnessed a shift in risk sentiment, and investors are moving towards riskier assets thanks to a sustained re-opening in the major economies.

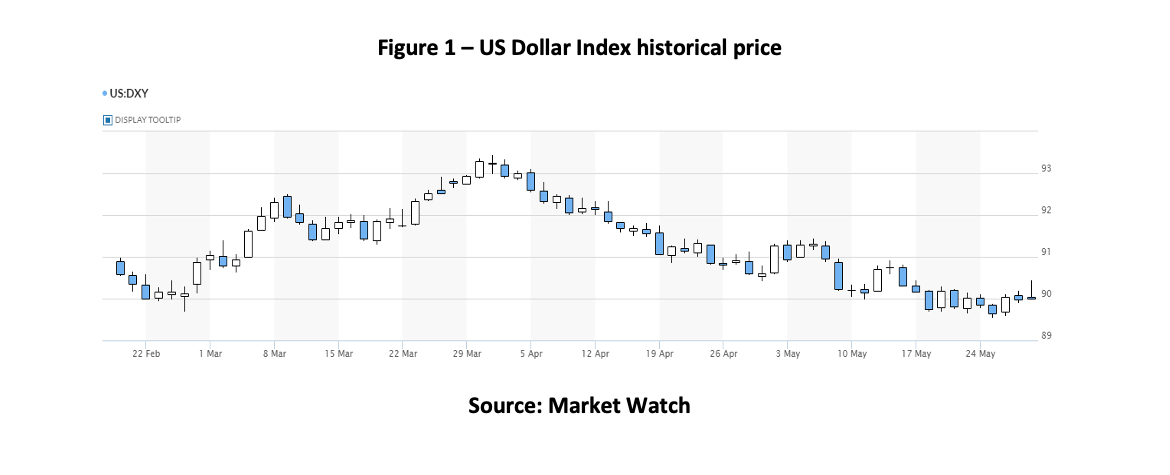

The risk-on sentiment has materialized on the US Dollar Index, a coefficient that benchmarks the greenback's performance against a basket of currencies, dropping almost 2% since the beginning of May and breaking three-month lows at 89.60 (Figure 1).

The increasing global confidence comes off the back of strong fundamentals from the European Union and the United Kingdom, which have shown a pickup in domestic demand and Unemployment.

The improvements in the metrics are shifting the narrative around growth prospects and monetary policy, especially from the Bank of England (BoE), which seems to be a solid candidate to hike rates before the Fed.

The Federal Reserve has now turned its focus to inflation and unemployment. Non-farm payrolls missed expectations with a poor release of 266k new jobs created in April Vs. 978k expected, as well as a revised of 770k new jobs created in March Vs. 916k previously released. Overall, unemployment increased to 6.1% in April, with a monthly variation of +0.1% (Figure 2.1 & 2.2).

However, inflation has shown a significant pick-up registering a change in the Consumer Price Index of 4.2% yearly and 0.8% monthly (Figure 3). The pickup in domestic demand is a healthy symptom of robust economic recovery which we are expecting to continue as the vaccination rollout progresses and economies re-open.

The mixed data left the market at the expectation of Federal Open Market Committee (FOMC) minutes to provide more color on interpreting these results. The FOMC minutes hinted that it will prompt the Fed to ease back on further stimulus if the rapid economic progress continues.

Still, Fed officials believe that any rate hike is far from the spectrum of possibilities, at least until the end of the year. The Fed's "hawkish" stance weighed on the USD throughout the month with different European and British inputs.

On the COVID front, President Joe Biden announced that half of U.S. residents are fully vaccinated against COVID-19, achieving an important milestone in the vaccination rollout. The White House aims to vaccinate 70% of American adults before the Fourth of July holidays by ramping up vaccine distribution while coronavirus cases and deaths drop. Additionally, the U.S. extended its vaccination program to younger people, and recent reports have proved that the vaccines are efficient against coronavirus variants.

As progress keeps being made in the vaccination front, restrictions have eased significantly. The U.S. Centre for Disease Control and Prevention updated its prevention guidelines allowing fully vaccinated people not to wear masks outdoors and can avoid wearing them in most places. The news was very well received by the public as the agency said it will allow life to begin to return to “normal” as fully immunized people will not need to social distance.

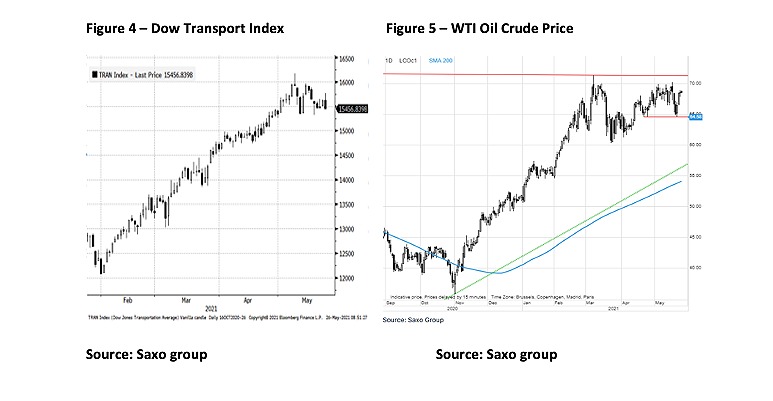

The new guidance says that fully vaccinated individuals can resume traveling and do not need to self-isolate after international trips or be tested. Domestic transportation in the U.S. saw a significant increase during the previous months due to loosening restrictions. The Dow Jones Transportation Index (Figure 4) is a composite that tracks the performance of the top 20 transport companies in the U.S. For May, the index slowed down as the sharp increase in oil prices (Figure 5) impacted these firms' cost structure, setting a pause in the latest growth.

The post-pandemic boom seems to be closer than ever. Strong unemployment and inflation figures have improved the growth prospect in the old continent for the summer in combination with robust vaccination rollouts.

However, tensions have started to mount again between the U.S. and China, as President Biden has re-opened the COVID investigation to determine the origins of the virus. China’s foreign ministry accused the U.S. of being political and blame-shifting muddying the waters in the process. Political tensions could bring a new wave of drivers that might change the current risk-on sentiment in the market.

June’s Economic Calendar

USD

On Tuesday (06/01): ISM Manufacturing PMI (May)

On Thursday (06/03): ADP Employment Change | ISM Services PMI

On Friday (06/04): Nonfarm Payrolls (May)

On Thursday (06/10): Consumer Price Index ex Food & Energy

On Friday (06/11): Michigan Consumer Sentiment Index

On Wednesday (06/16): Retail Sales Control Group | Retail Sales (MoM) | FOMC Economic Projections | Fed Interest Rate Decision | Fed’s Monetary Policy Statement | FOMC Press Conference

On Wednesday (06/23): Bank Stress Test Info

On Friday (06/25): Durable Goods Orders | Nondefense Capital Goods Orders ex Aircraft

On Sunday (06/30): Gross Domestic Product Annualized

EUR

On Tuesday (06/01): Consumer Price Index

On Wednesday (06/02): Retail Sales Germany

On Friday (06/04): Retail Sales EU

On Tuesday (06/08) Gross Domestic Product

On Thursday (06/10): ECB Interest Rate Decision | ECB Deposit Rate Decision | ECB Monetary Policy Statement and Press Conference

On Friday (06/11): G7 Meeting

On Saturday (06/12): G7 Meeting

On Sunday (06/13): G7 Meeting

On Wednesday (06/16): Harmonized Index of Consumer Prices (YoY)

On Wednesday (06/23): Markit Manufacturing PMI | Markit PMI Composite

On Thursday (06/24): European Council Meeting

On Thursday (06/25): European Council Meeting

On Wednesday (06/30): Consumer Price Index | Harmonized Index of Consumer Prices

GBP

On Tuesday (06/01): BoE’s Governor Bailey speech

On Thursday (06/03): BoE Monetary Policy Report Hearings | BoE’s Governor Bailey speech

On Tuesday (06/15): Claimant Count Change | ILO Unemployment Rate (3M)

On Wednesday (06/16): Consumer Price Index

On Wednesday (06/23): Markit Service PMI

On Thursday (06/24): BoE MPC Vote Unchanged | BoE Asset Purchase Facility | Monetary Policy Statement | BoE MPV Vote cut | Bank of England Minutes | BoE MPC Vote Hike | BoE Interest Rate Decision

On Thursday (06/30): Gross Domestic Product

JPY

On Thursday (06/03): Overall Household Spending

On Monday (06/07): Leading Economic Index | Current Account

On Friday (06/17): National CPI ex Food, energy | National CPI ex-fresh food | National Consumer Price Index | Merchandise Trade Balance Total | Imports (YoY) | Exports (YoY)

On Friday (06/18): Monetary Policy Statement | BoJ Interest Rate Decision | BoJ Press Conference

On Tuesday (06/22): BoJ Monetary Policy Meeting Minutes

On Thursday (06/24): Tokyo CPI ex Fresh Food | Tokyo CPI ex Food, Energy (YoY)

On Monday (06/28): Unemployment Rate | Retail trade | Industrial Production

CAD

On Tuesday (06/01): Gross Domestic Product Annualized (QoQ)

On Friday (06/04): Unemployment Rate | Net change in Employment

On Friday (06/09): BoC Rate Statement | BoC Interest Rate Decision

On Wednesday (06/16): Bank of Canada Consumer Price Index

On Wednesday (06/23): Retail Sales

MXN

On Thursday (06/03): Consumer Confidence

On Wednesday (06/09): 12-Month Inflation | Core Inflation | Headline Inflation

On Friday (06/11): Industrial Output

On Friday (06/18): Private Spending

On Wednesday (06/23): Retail Sales | 1st Half Month Inflation |

On Thursday (06/24): Central Bank Interest Rate

On Monday (06/28): Trade Balance

CNY

On Tuesday (06/01): Caixin Manufacturing PMI (Apr)

On Thursday (06/03): Caixin Services PMI (Apr)

On Monday (06/07): Exports | Imports

On Wednesday (06/09): Consumer Price index | Producer Price Index

On Thursday (06/10): Foreign Direct Investment (YTD)

On Tuesday (06/15): NBS press Conference | Retail Sales

On Wednesday (06/16): Industrial Production

On Monday (06/21): PBoC Interest Rate Decision

On Wednesday (06/30): NBS Manufacturing PMI | Non-manufacturing PMI

BRL

On Tuesday (06/01): Gross Domestic Product | HSBC PMI Manufacturing | Trade Balance

On Wednesday (06/02): Fipe’s IPC Inflation | Industrial Output

On Monday (06/07): IPCA Inflation

On Tuesday (06/08): Retail Sales

On Wednesday (06/16): Interest Rate Decision

On Monday (06/21): Current Account

On Wednesday (06/30): Primary Budget Surplus | Nominal Budget Surplus