The CFO of a Fortune 500 company is continually fighting a battle of risk and reward. Like any general before a battle, a great CFO creates plans (and backup plans!), focuses on execution, and generates an "after-action report" to review his performance. Before he can begin to plan, he must be clear on the objectives.

Clear objectives:

Is the goal to protect the balance sheet or the P&L? Should accounting results be prioritized over cash flow impacts? Objectives should be defined in the FX Policy (you do have one...). Not only will clearly defined objectives help develop strategies to achieve them, but it will also help the CFO defend his finance dept when ill-conceived performance measures are proposed (e.g. were the hedges profitable?).

Sample objectives might include: eliminate FX risk, minimize hedge costs, hedge to obtain a competitive advantage, minimize FX volatility over the multi-year horizon, or add value through active hedging or speculative positions. If the objectives include adding value through active hedging or speculation, guidance is needed to allow or disallow specific risky actions: closing out hedges prior to maturity, leaving positions open; keeping successful hedges on even if the original forecast underlying exposure disappears; increasing a net position with a derivative; and reversing a net position with a derivative (e.g., making a net long position short).

The policy should specify which risks are important and should be hedged, and which are not. The list of risk categories is long: third party booked transactional exposures; intercompany booked transactional exposures; third party or intercompany debt; contractual future foreign currency commitments (e.g., multi-year contracted capital expenditure payments in foreign currency); anticipated but not yet booked future foreign currency revenues and expenses; foreign unit earnings (i.e., P&L translational exposures); foreign unit booked and anticipated dividends; and foreign unit balance sheet equity. Once the objectives are agreed-to and documented (important), then the strategies for achieving them must be devised.

Strategy

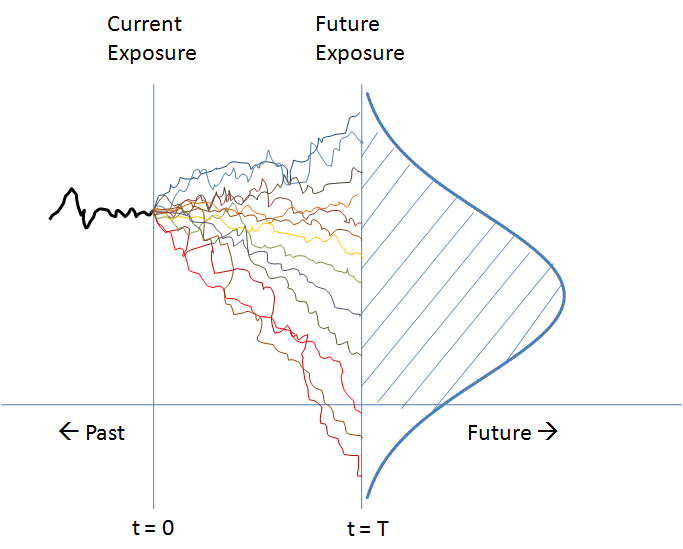

Developing a strategy to meet objectives involves three "sub" steps. The first step is to measure risk and identify the material bits. For example, an aerospace mfg firm may have multi-year lead times, during which FX rates may vary significantly. There are numerous tools for estimating risk, the most common among them being Value at Risk (VaR). This is a metric that makes assumptions about future market volatility and distributions and calculates a single number which represents the upper limit of loss with a specified degree of confidence. VaR is specific to one local currency and one tenor.

Another measure that nicely complements VaR is Expected Shortfall, which quantifies the losses beyond the VaR confidence interval.

The second step is to devise hedging strategies that will minimize the material risks. For our aerospace mfg firm, managing its future cash flow risk might be done using layered hedging (fig 1). This well-known technique can reduce effective year over year volatility by 70% or more, but requires managing a large number of open hedges.

Fig 1. Layered Hedging Program

For firms with long cash cycles (i.e. A/R or A/P remaining on the Balance Sheet for many months), managing remeasurement risk may be deemed necessary to minimize impacts to the Income Statement. While conceptually simple, developing a reliable Balance Sheet forecasting methodology and integrating balance sheet hedges with maturing cash flow hedges is non-trivial.

Firms with foreign entities may be exposed to translational risk (as opposed to transactional risk as above.) Both FX policy and regulatory requirements will dictate whether these foreign entities are deemed local currency functional or reporting currency functional. That, in turn, will drive a hedge strategy (i.e. centralized at the group level or locally). Generally, group-level hedging of exposure against the reporting currency offers the most comprehensive opportunity for netting exposures and minimizing total hedge volume.

Now that the hedge notionals and tenors have been determined, the third step is to decide how to hedge them. Forward contracts are the simplest to understand, manage and account for, and in many cases are very cost-effective. If the local currency is in a long-term trend or very volatile, the high cost of option premiums may be justified but may cause issues if Special Hedge Accounting is elected. Monte Carlo simulations may be used to good effect in identifying the optimum combination of options and their parameters (tenor`s, strikes, notionals).

Lastly, if a firm has exposure to emerging markets, where forwards are either unavailable or prohibitively expensive, other alternatives (such as proxy hedging) may be necessary.

Now that the hedges have been fully defined, the CFO can focus on execution.

Execution

After (and only after) he has set a strategy, he can focus on efficient execution. The FX market is large, opaque and not a place for the inexperienced or uninformed. Information asymmetry is large. Banks make the majority (58%) of their derivative profit from the FX market. When dealing, CFOs always know where the market is. A Bloomberg terminal may be found in the largest corporates.

Smart CFOs employ Transactional Cost analysis (TCA) (Fig 2) to evaluate the spread they are paying on spot and forward trades, and use this information to negotiate rates commensurate with trade size and currency pair.

Fig 2. TCA - Transaction Cost Analysis

Smart CFOs use counterparties that require little to no initial or variation margin to minimize credit requirements.

Metrics

Establishing metrics for FX risk management is essential to ensure that the effectiveness of the strategy can be measured, and changed if required. Also, it might someday help to ensure the finance group does not suffer under unrealistic expectations.

A metric is a number that measures performance. A benchmark, or standard, is how we determine whether the performance measured is acceptable. A metric is useless until it is compared to a performance standard. For example, in sports cars, one performance metric is the 0-60 mph time. The benchmark might be 4 seconds.

In FX risk management, one of the objectives might be the minimization of volatility. Thus, the metric is earnings volatility. A corresponding benchmark might be "less than 5%".

Conclusion

The CFO is now prepared for battle as well as any Fortune 500 CFO. He has objectives which have been determined and agreed to by the BoD or C-suite, and documented in an FX Policy for his department and his successors. Knowing which risks he is responsible for (and which he is not), he and his team can devise strategies that should meet those objectives.

Having set the strategies, and determined the precise nature of his exposures (tenors, notionals), he may utilize computational methods such as Monte Carlo analysis to select the optimum hedging instruments. He carefully selects his counterparties and holds them accountable for execution costs using TCA.

Lastly, he measures how well he and his team did. FX risk management without metrics and benchmarks is like playing tennis without a net. More importantly, metrics and benchmarks give him objective feedback on whether his strategies are working, or need modification to meet objectives.