Your Partners in Risk & Returns

Deaglo’s hybrid advisory + technology model delivers clarity, confidence, and control across every dimension of treasury and accounting.

Deaglo empowers corporates to manage FX volatility, strengthen financial control, and streamline accounting with precision. Our hybrid approach combining strategic advisory, intelligent technology, and seamless execution enables CFOs and treasurers to safeguard profitability and enhance governance.

Mitigate currency and rate volatility through proactive hedging.

Real-time insights for transparent, data-driven decision-making.

Audit-ready accounting aligned with IFRS 9 and ASC 815.

Integrate treasury workflows and automate reporting.

Unified view of exposures, hedges, and performance across entities.

Full automation of IFRS 9 / ASC 815 documentation and reporting.

Enhanced control, stronger oversight, and reduced operational burden.

Reduced operational and hedging costs through smarter execution and automation.

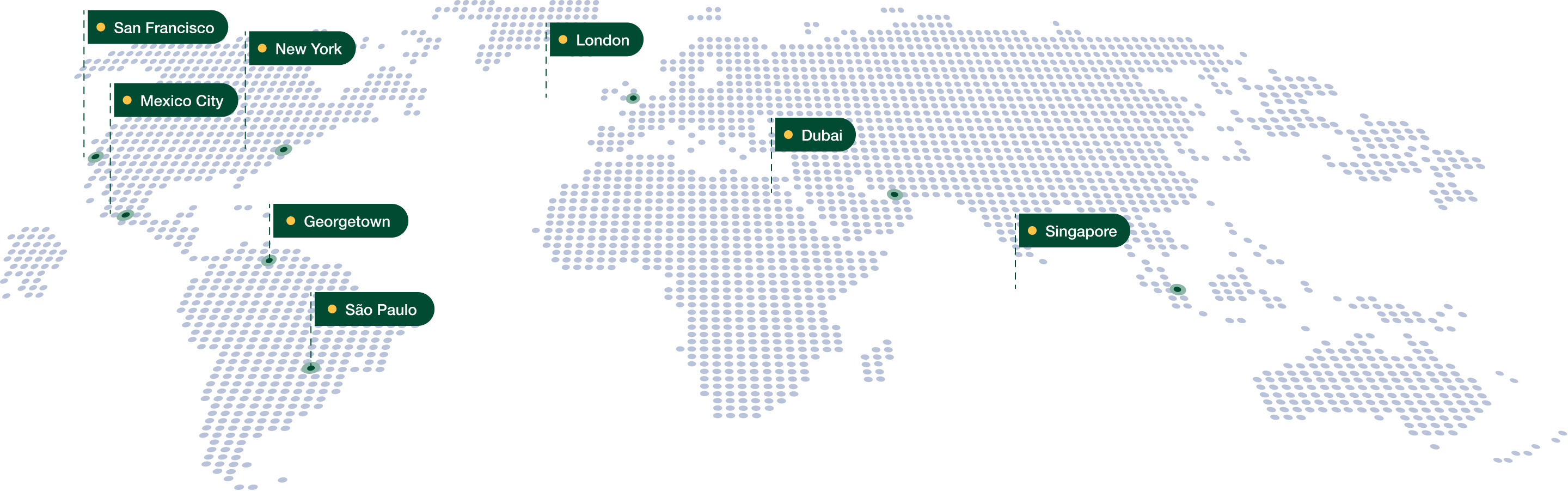

Deaglo is bringing local insight to global markets. Our strategic presence ensures we understand regional dynamics, stay connected to decision-makers on the ground, and deliver precision where it matters most.

Deaglo’s hybrid advisory + technology model delivers clarity, confidence, and control across every dimension of treasury and accounting.

Deaglo is an AI powered financial technology platform that specializes in foreign exchange (FX) risk management. It helps companies and investors understand, model, and mitigate the risks associated with currency volatility. Deaglo’s platform offers strategy performance simulations, hedging strategy optimization, and risk exposure tracking to support better decision-making around cross-border capital flows and transactions.

Deaglo’s platform is primarily designed for FX dealers, business development teams and risk management consultants working at Financial Institutions such as banks and MSBs who cater to the following clients:

However, there are many tools to which funds and corporates can benefit from on the platform such as Strategy Simulator and Client Portal to manage their cash flows and trades.

Deaglo functions primarily as a decision support tool, not a trading platform such that execution of FX trades must still happen through a separate broker or bank. In essence, the platform helps users understand their FX risk exposures, simulate different hedge strategies, and collaborate with treasury teams to design risk management plans.

Deaglo stands apart from traditional FX consultants and banks by offering a technology-first, transparent approach to FX risk management. While banks may offer FX products and limited advisory services, their recommendations often align with internal incentives and can lack impartiality. FX consultants, on the other hand, may rely on manual processes and lack real-time analytical capabilities.

Deaglo bridges this gap by digitizing FX strategy modeling and providing independent, data-driven insights. The platform uses advanced analytics and scenario simulations to assess risk and recommend optimal strategies, eliminating guesswork and minimizing bias. Clients retain full control over execution and are empowered with tools that promote autonomy and clarity in their risk management decisions.

Yes, Deaglo is built with integration flexibility in mind, making it easy to connect with clients’ existing infrastructure. Whether your organization uses ERP systems like SAP, Oracle, or NetSuite, or relies on treasury or accounting platforms, Deaglo can ingest data from these systems to generate a holistic view of FX exposures. This allows for automation of data workflows, real-time exposure analysis, and synchronized reporting across teams. Such integration ensures that decisions are based on the most current and accurate financial data, reducing the risk of errors and enhancing operational efficiency.

While Deaglo’s pricing details are not publicly listed, its offerings are typically structured around a subscription-based model, with options tailored to the size and complexity of each client’s needs. Pricing may vary depending on the number of users, depth of features (such as real-time simulations, reporting, and API access), and whether the organization requires enterprise-level integration or support. In general, prospective clients can expect flexible pricing tiers designed to scale with usage—from small corporate treasury teams to large investment firms. For an accurate quote, it’s best to engage directly with Deaglo’s sales or customer success team.

Yes, Deaglo provides API access to support custom integrations and facilitate seamless connectivity with external systems. This allows organizations to automate data flows between Deaglo and their internal platforms, such as CRM, ERP, or treasury management systems. With APIs, users can pull exposure data, send hedge strategy results to dashboards, or embed risk metrics into proprietary financial models. This capability is especially valuable for firms looking to streamline operations, enhance data consistency, and customize workflows without relying on manual exports or duplicate entry.

Getting started with Deaglo is straightforward. Interested users can request a product demo directly through the company’s website or by contacting the sales team. These demos are typically personalized based on the client’s industry and FX risk profile, ensuring that the walkthrough highlights features most relevant to the organization’s needs. In many cases, Deaglo also offers pilot programs or limited-time free trials to allow teams to explore the platform’s capabilities before making a commitment. During onboarding, clients receive support in setting up their risk models, connecting systems, and interpreting initial results, ensuring they derive value from day one.

Deaglo’s platform incorporates AI and machine learning into various platform tools such as:

Security is a core pillar of Deaglo’s platform and a key part of our value proposition, especially for financial institutions and enterprise clients. We follow best in class data privacy and data minimization, and have the highest bar for privacy and security requirements