Economic outlook

Industrial output fell at the sharpest rate in nearly two years in March, while retail sales dropped at the fastest pace in over four years in the same month, and economic activity dropped 9.7% month-on-month in seasonally-adjusted terms in April, the worst ever recorded. This followed a fall in March of -6.2% month-on-month.

In Q2, manufacturing PMI fell to a record low in April as factory closures and weaker demand battered production and new orders.

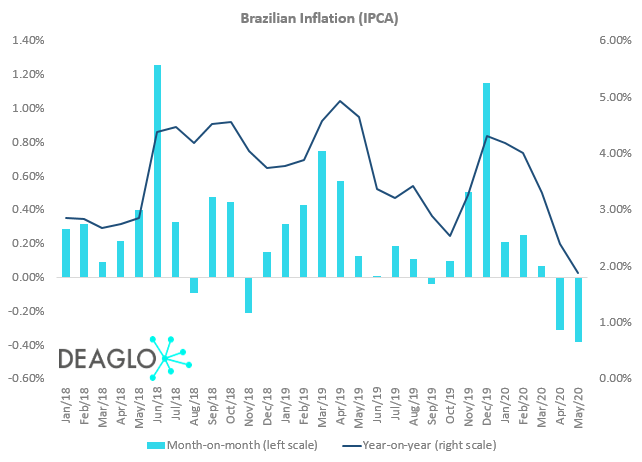

Consumer prices dropped a seasonally-adjusted 0.38% in May over the previous month, marking the sharpest fall in prices since August 1998 (-.51%). It was close on the heels of the 0.31% fall in April. See fig 1 below.

fig 1 Source: Brazilian Institute of Geography and Statistics (IBGE).

Several investment banks have cut their 2020 outlooks in recent days, with BofA Securities issuing one of the gloomiest projections, revising its GDP call to -7.7% from -3.5%.

Against the current backdrop, Fitch Ratings revised Brazil’s BB- credit rating outlook to “negative” from “stable”.

Government and Central Bank

The Brazil government cut its 2020 GDP forecast to -4.7%, the biggest fall since 1900. The economy will only return to its pre-crisis levels of December last year by 2022, the ministry said, a slower recovery than that suggested by Economy Minister Paulo Guedes.

In response, on May 6th the lower house of Congress passed the so-called “war budget”, unlocking an estimated BRL 800 billion for recovery measures. The Senate also did its part, approving a BRL 60 billion aid package to help the states.

With incoming data suggesting the effects will get even worse, the Central Bank of Brazil’s Monetary Policy Committee (COPOM) unanimously decided to chop the benchmark SELIC interest rate from 3.00% to a new historical low of 2.25%. The cut marked the eighth consecutive cut since July 2019, and the second meeting straight that the Bank dropped the rate by 75 basis points. Those are huge cuts.

While COPOM deemed the size of the current response as adequate, it left the door open for a further 25 bps stimulus if necessary.

FX

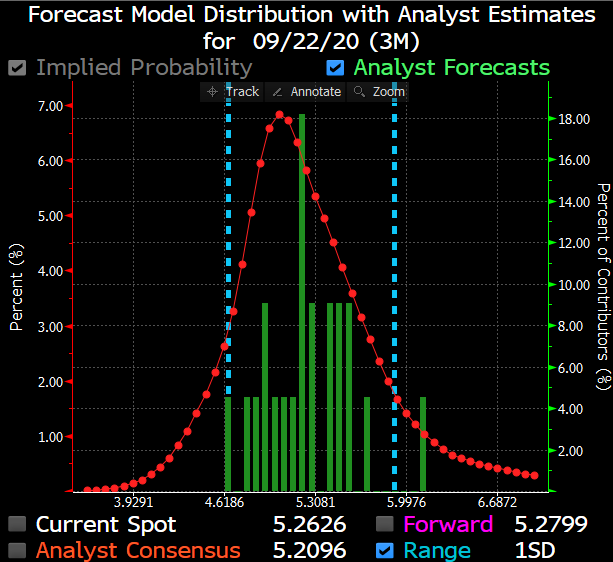

BRL recovered a bit from its nearly 6 handle to slightly below 5, before falling yet again. The current spot is 32% below where it started in 2020.

USDBRL is obviously one of the more volatile EM pairs, clocking in at 15%/annum (4.4%/month!). This corresponds to a VaR (95%) of 25%. Definitely a material risk which should be managed.

Hedging costs

Fortunately, as central banks have been busily reducing rates, the cost of hedging has come down dramatically. It's currently roughly 1%/year, favoring selling USD/buying BRL.