Our FX Market insight will help you understand recent fluctuations and the main FX drivers for February.

Overview

The contrast between the situation we lived in late 2020, the one we are currently experiencing, and the one we are hoping to see in a few months is enormous. At the end of 2020, the effectiveness demonstrated by coronavirus vaccines and their ambitious distribution agenda allowed us to be optimistic. Many countries have lowered their guard against the pandemic and, confident that 2021 would bring a fresh start, began celebrations for the arrival of the new year.

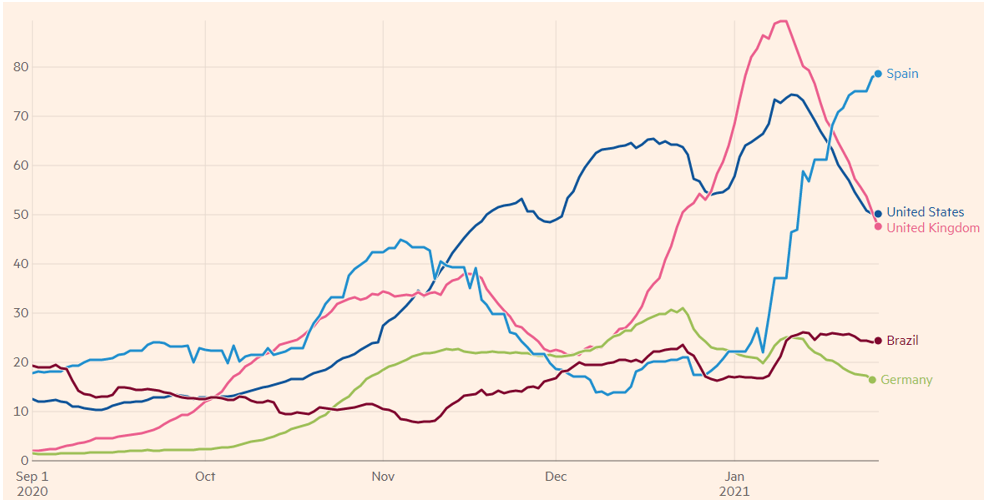

As a consequence, throughout January, hospitals in the United States, Europe, and Latin America were once again exposed to the depth of the crisis that was emerging in the form of a third wave of contagions, which so far has had a dramatic effect (Fig. 1).

Figure 1. New confirmed cases of Covid-19 in United States, United Kingdom, Germany, Spain and Brazil. Seven-day rolling average of new cases (per 100k)

Source: Financial Times analysis of data from the World Health Organization, the Covid-19 Tracking Project, the Johns Hopkins CSSE, the UK Government coronavirus dashboard, the Spanish Ministry of Health and the Swedish Public Health Agency.

Amid escalating Covid-19 cases, the ambitious distribution and production schedule of vaccines began to show weaknesses that were repressed during political articulation. With a shortage of supplies being felt across Europe, Spain has become the first nation in the bloc to partially suspend immunizations for a lack of doses. The situation soon turned into an increasingly heated dispute between the European Union, the United Kingdom, and pharmaceutical companies, which raises concerns about the international competition for limited supplies of the vaccines needed to end the pandemic.

In the United States, the scenario does not differ radically. Responding to increasing pressure from some states, such as New York, the new U.S administration continues to work to buy 200 million additional doses and provide enough doses to vaccinate 300 million Americans by the end of the summer or early fall.

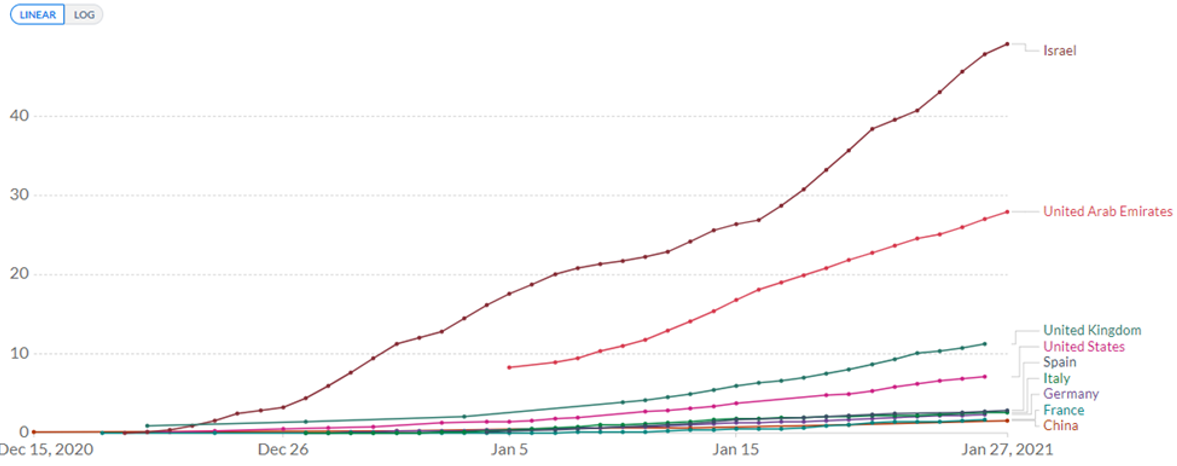

The vaccination rate can be seen in Figure 2.

Figure 2. Cumulative COVID-19 vaccination doses administered per 100 people

Source: Official data collated by Our World in Data

Apart from the health crisis, January has not only brought Joe Biden into office as the 46th President of the United States, but has also confirmed that both Congress and the Senate will be led by Democrats.

So, in the next few months, we are likely to see a proposal for another massive $1.9 trillion relief injection (equivalent to almost 9% of GDP) to take on more form, although it also means that Republicans may try to negotiate a smaller package.

We will also see other projects taking shape, such as Biden's environmental agenda. The White House should plan to enact new decrees to "tackle the climate crisis", both inside and outside U.S borders, and to reinforce the call for worldwide cooperation.

Foreign Exchange Market

Although the backdrop to January was very much a health crisis, the market reacted positively to Joe Biden's inauguration as President of the USA, which limited the performance of safer assets and boosted riskier assets, such as the S&P 500 (Fig. 3).

Figure 3. Performance in % of assets considered safe-haven (CHF/USD, USD/JPY, Gold and USD) and risky (S&P 500)

Source: Bloomberg

The vision of a weaker dollar for February continues to be based on mass vaccination and the belief that an increasing number of people will be vaccinated in the coming months, allowing most mobility restrictions to be definitively eliminated. When this happens, economic activity will accelerate and much of the decline that occurred with the outbreak of the pandemic may be reversed, albeit heterogeneously across sectors and regions.

Central banks, in particular the Fed and the European Central Bank, are also key players, as they have managed to convince markets that they will keep interest rates at historic lows, even beyond the moment when economic activity exceeds pre-pandemic levels.

In this sense, valuations in the stock market are also expected, since they also take into account the expected positive impact of the various fiscal stimulus plans that are expected to be carried out shortly.

February’s Economic Calendar

USD

On Monday (02/01): ISM Manufacturing PMI (Jan)

On Friday (02/05): Unemployment Rate (Jan)

On Wednesday (02/10): Core Consumer Price Index (Jan)

On Monday (02/15): United States - Presidents' Day - Holiday

On Wednesday (02/17): Retail Sales (MoM) (Jan)

EUR

On Monday (02/01): Germany - Manufacturing PMI (Jan)

On Thursday (02/04): ECB Economic Bulletin

On Friday (02/12): Industrial Production (Dec)

On Tuesday (02/16): German ZEW Current Conditions (Feb)

On Thursday (02/18): Consumer Price Index (Jan)

GBP

On Monday (02/01): Manufacturing PMI (Jan)

On Wednesday (02/03): Composite and Services PMIs (Jan)

On Thursday (02/04): BoE Interest Rate Decision (Feb)On Friday (02/12): GDP (Q4) | Manufacturing Production (Dec)

On Wednesday (02/17): Consumer Price Index (Dec)

On Friday (19/02): Retail Sales (Jan)

JPY

On Tuesday (02/02): Services PMI (Jan)

On Thursday (02/04): Household Spending (Dec)

On Thursday (02/11): Japan - National Day Holiday

On Sunday (02/14): GDP (Q4)

On Tuesday (02/16): Trade Balance (Jan)

On Thursday (02/18): Consumer Price Index (Jan)

CAD

On Friday (02/05): Ivey PMI (Jan)

On Friday (02/12): Wholesale Sales (Dec)

On Monday (02/15): Canada - Family Day Holiday | Manufacturing Sales (Dec)

On Tuesday (02/16): Housing Starts (Jan)

On Wednesday (02/17): Consumer Price Index (Jan)

MXN

On Monday (02/01): Mexico - Constitution Day Holiday

On Tuesday (02/09): Consumer Price Index (Jan)

On Thursday (02/11): Interest Rate Decision (Jan) | Industrial Production (Dec)

On Wednesday (02/24): Unemployment Rate (Dec)

CNY

On Tuesday (02/09): Consumer Price Index (Jan) | Producer Price Index (Jan)

On Thursday (02/11): China - Spring Festival Holiday

BRL

On Monday (02/01): Markit Manufacturing PMI (Jan)

On Tuesday (02/02): Industrial Production (Dec)

On Wednesday (02/03): IPC-Fipe Inflation Index (Jan)

On Tuesday (02/09): Brazilian IPCA Inflation Index (Jan)

On Wednesday (02/10): Retail Sales (Dec)

On Friday (02/12): IBC-Br Economic Activity (Dec)

On Monday (02/15): Brazil - Carnival Holiday