Key takeaways

Rolling hedging strategies are widely utilized long-term hedging techniques by many private equity fund managers.

Despite this, fund managers face a specific challenge. That is in managing liquidity risk.

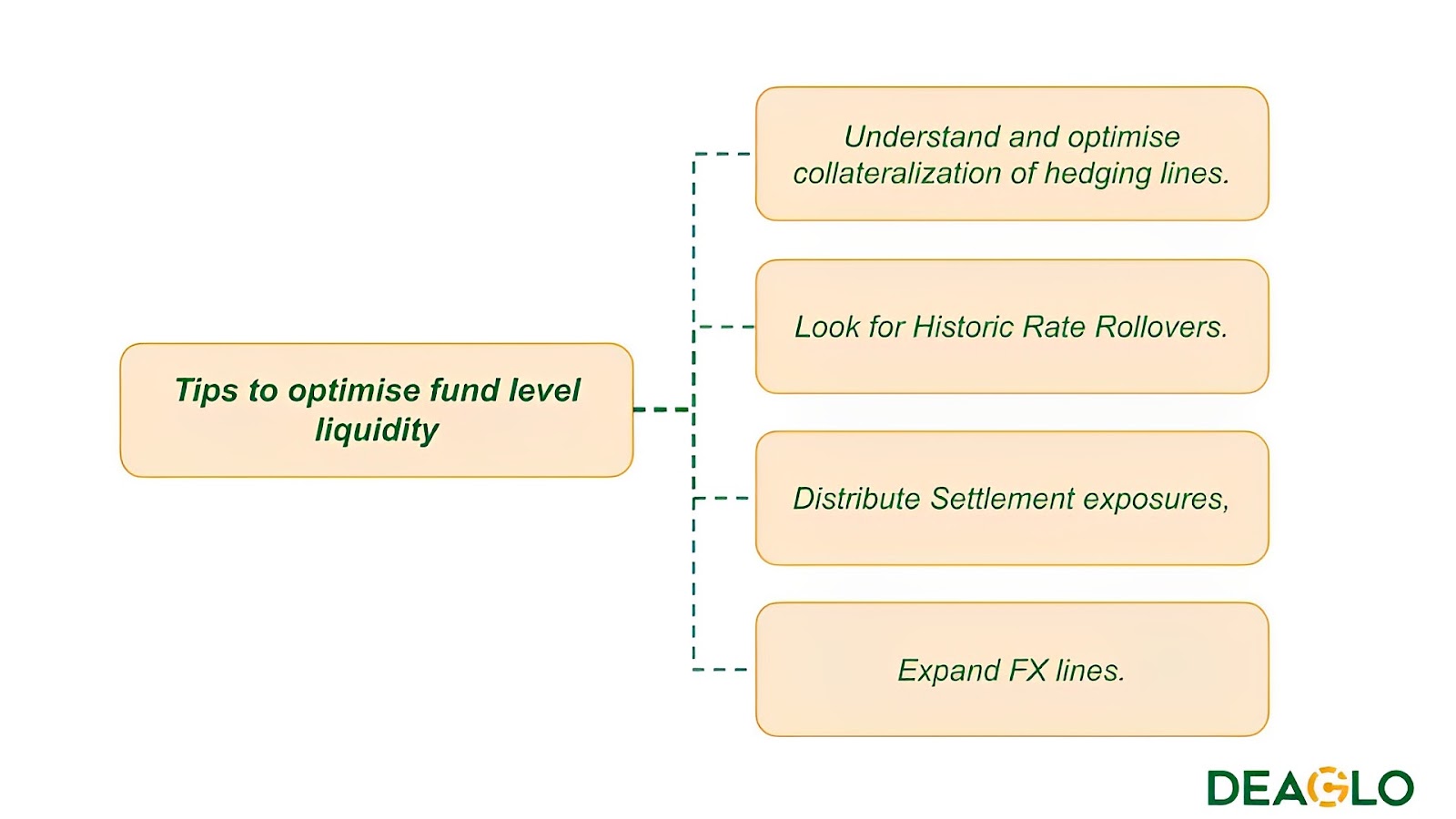

According to our experts, the best strategies for effective liquidity management are comprehending the collateralization of hedging lines, looking for historic rate rollovers, distributing settlement exposures, and ultimately expanding FX lines.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

When it comes to hedging offshore investments, there is no one-size-fits-all solution. Several fund managers seek to hedge projected cash flows, while others use the rolling FX hedge structures for asset-level hedging (Net Asset Value).

According to a Bloomberg research article, the rolling FX hedges technique has been widely used in recent years because it encourages treasury departments to review their exposure projections and keep an eye on favorable moves in the FX market on an ongoing basis. It is a common strategy used by many credit fund managers. Rolling hedges are also used in asset-level hedging by private equity funds and other illiquid structures.

Even though the rolling FX hedges program effectively protects asset performance from FX volatility, managers are nevertheless exposed to a specific challenge. That is managing liquidity risk, which emerges from their derivative contracts' collateralization.

A recent study confirms that liquidity management is a significant concern for asset owners and fund managers. This was prevalent during the 2008-9 financial crisis and again during the 2020 Covid-related market turbulence.

We have highlighted the four best strategies that help asset owners and fund managers effectively manage liquidity for their forward-based FX rolling programs*.

*Note: Margin/collateralization arrangements can differ based on whether or not the contract is deliverable, the jurisdiction of the hedging firm, and credit profile, among other factors. For simplicity purposes, we have chosen to limit the scope of this article to solely forward-based or similar products, eliminating options, cross-currency swaps, and other exotic instruments.

1. Optimize collateralization of hedging lines.

Understanding the extent of forward instruments in the context of several jurisdictions is one of the challenges that managers confront when it comes to collateral for hedging. This complexity makes it challenging to obtain the most competitive terms.

Deliverable forwards are frequently exempt from margin requirements, but this differs when a fund manager is exposed to developed markets. It leads to many jurisdictions facing various regulatory problems and limits when actively managing FX risk. That's where fund managers will broaden their alternatives and might pursue non-deliverable forwards (NDFs).

Such contracts (NDFs) feature comparable pricing mechanics to vanilla forwards. Still, they take an entirely different approach to settlement, collateralization, and regulations, as these contracts are classified as risky and require full margin when traded in a fully regulated environment.

Furthermore, traditional banks struggle to offer credit facilities (to avoid posting margins) to U.S.-based firms while trading NDFs, although numerous non-bank counterparties are willing to do so under specific conditions.

The overall message is that fund managers should strive to understand the universe of collateralization requirements and evaluate the options available to build appropriate relationships that reduce the need to post collateral.

Deaglo assists you in this aspect by providing a tech-powered investment platform that allows you to model the optimal margins required when employing various collateralized products. Join the Pioneer Group list to get a first-hand experience of our investment platform.

2. Explore credit-intensive products (HRRs).

In the private equity space, it is mainly observed that the liquidity characteristics of a fund are very constrained, given the nature of its operation. It is challenging to accurately predict when cash events will occur amid the complexities and contingencies of the underlying deals.

Credit-intensive instruments, such as Historic Rate Rollovers (HRRs), can be an ideal solution to meet funding demands in the face of these liquidity constraints. HRRs enable the user to roll the hedge at the historical rate at which the forward was initially booked, netting the settlements on the rolling date to zero. When the HRR is booked, the distant leg of the roll will be changed, agreed upon, and defined.

This is especially useful in long-term business instances when it is difficult to obtain hedging liquidity. This allows the trade to be rolled for an extended period without settling the PnL or resetting the hedge. However, due to the product's credit-intensive characteristics, it will be more expensive to trade than traditional products, although offering significant synergies in posting requirements. As a result, there is no such thing as a free lunch.

3. Distribute settlement exposure across value dates.

Many managers focus on drivers such as hedging impact or underlying asset distributions and reset rates when selecting the tenor of a hedging program.

Because this article is limited to FX forwards and associated products, the impact of these contracts (positive or negative) is calculated as the interest rate differential between the two central bank benchmark rates on a specific currency pair. When we annualize the forward curve, we can determine which tenor maximizes the impact of hedging. On the other hand, having a single net position rolling at a specific date exposes the fund to significant liquidity and settlement risk at the rolling date. One remedy is to distribute the settlement across various value dates.

To understand this with an example. Assume a fund manager determines that the ideal rolling tenor is annual and the fund has USD 100 million in an exposure. If the fund hedged USD 100 million for one year, the FX could move against the hedger, forcing the hedger to settle a substantial PnL on the position, despite the beneficial impact on the underlying asset.

Instead, the fund might divide its total investment into quarterly expiries, investing USD 25 million at the end of each quarter and rolling each expiry over annually. By lowering exposure to USD 25 mill quarterly, the fund was able to optimize the hedging tenor and decrease settlement and liquidity risk.

As previously said, there is no one-size-fits-all approach to hedging. Still, a similar logic can be utilized in varied instances to provide more flexibility in managing liquidity at the fund level. Moreover, learn about forward contracts' efficiency using our Forward Efficiency Tool.

4. Expand the FX panel.

Diversifying the FX panel is a subtle technique for keeping providers aware of the competition and assessing the risk appetite of various market participants or stakeholders.

Furthermore, diversifying counterparty risk is a significant advantage of this strategy because the hedging contracts would be confronting numerous suppliers rather than a single player focusing on all of this risk.

Expanding the FX panel also boosts the fund's liquidity buffer and FX facilities, with counterparties exposed to little risk. It is typical for counterparties to underwrite these facilities against Net worth (NAV + uncalled capital), with a proportion ranging from 1 to 4%. As these criteria are determined, managers should take advantage of these capabilities by spreading out FX transaction allocation, optimizing liquidity requirements, and lowering collateral posting.

As a result, there is no one-size-fits-all solution for FX risk management. Using these strategies, a fund manager would effectively manage liquidity while executing rolling hedges.

The image below shows all the options available.

Four practical strategies for managing liquidity at the fund level. Image: Deaglo.

Note: These are not the only exact solutions for enhancing your fund's liquidity management; however, they highlight all of the possibilities that should be explored to optimize fund-level liquidity.

Thank you for reading so far; a summary of the essay is provided below.

- There is no one-size-fits-all when it comes to FX risk management.

- Instead, rolling strategies help managers to protect long-term investments or scenarios where cash events are difficult to predict.

- To optimize margin requirements and liquidity management at a fund level, managers should strive to understand the universe of collateralization requirements and assess the options available to form cooperative relationships that minimize the need to post collateral.

- Historic Rate Rollovers allow the user to roll the hedge at the Historic Rate at which the forward was initially booked, netting the settlements on a rolling date to Zero.

- Distributing hedges across different value dates and keeping the hedging book clean is an efficient tool for managing liquidity effectively and planning cash management.

- Finally, a diversified FX panel can help you minimize counterparty risk, keep providers aware of the competition and maximize the credit facilities available to avoid posting unnecessary margins.

If you are a GP, who is looking to hedge offshore investments, or considering using FX rolling hedges, speak to one of our experts today to optimize your fund's liquidity.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------