Key takeaways

- An FX Forward contract or forward is a popular tool for hedging in forex markets. Depending on the currency pair and trade (buying or selling), they might be favorable or unfavorable to the hedger.

- Despite being a common strategy for hedging in forex markets, there are few tools and limited understanding of the efficacy of forwards or, in other words, how much it is favorable to the hedger. The Forward Efficiency Tool by the Deaglo FX platform fills that gap.

- This simple yet powerful tool shows an ultimate way of valuing a forward contract, resulting in data-driven decisions about whether or not to hedge.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1. FX Forward contract: A brief introduction.

Since the 2008 Global Financial Crisis, increased financial and commercial interdependence across countries has significantly increased demand for foreign exchange rate protection. The FX Forward contract or forward is a commonly used tool for hedging in forex markets.

FX Forward contracts allow businesses to lock in a future exchange rate today. They are made up of forward rates, which consist of spot rates and forward points.

Forward rate = Spot rate + Forward points.

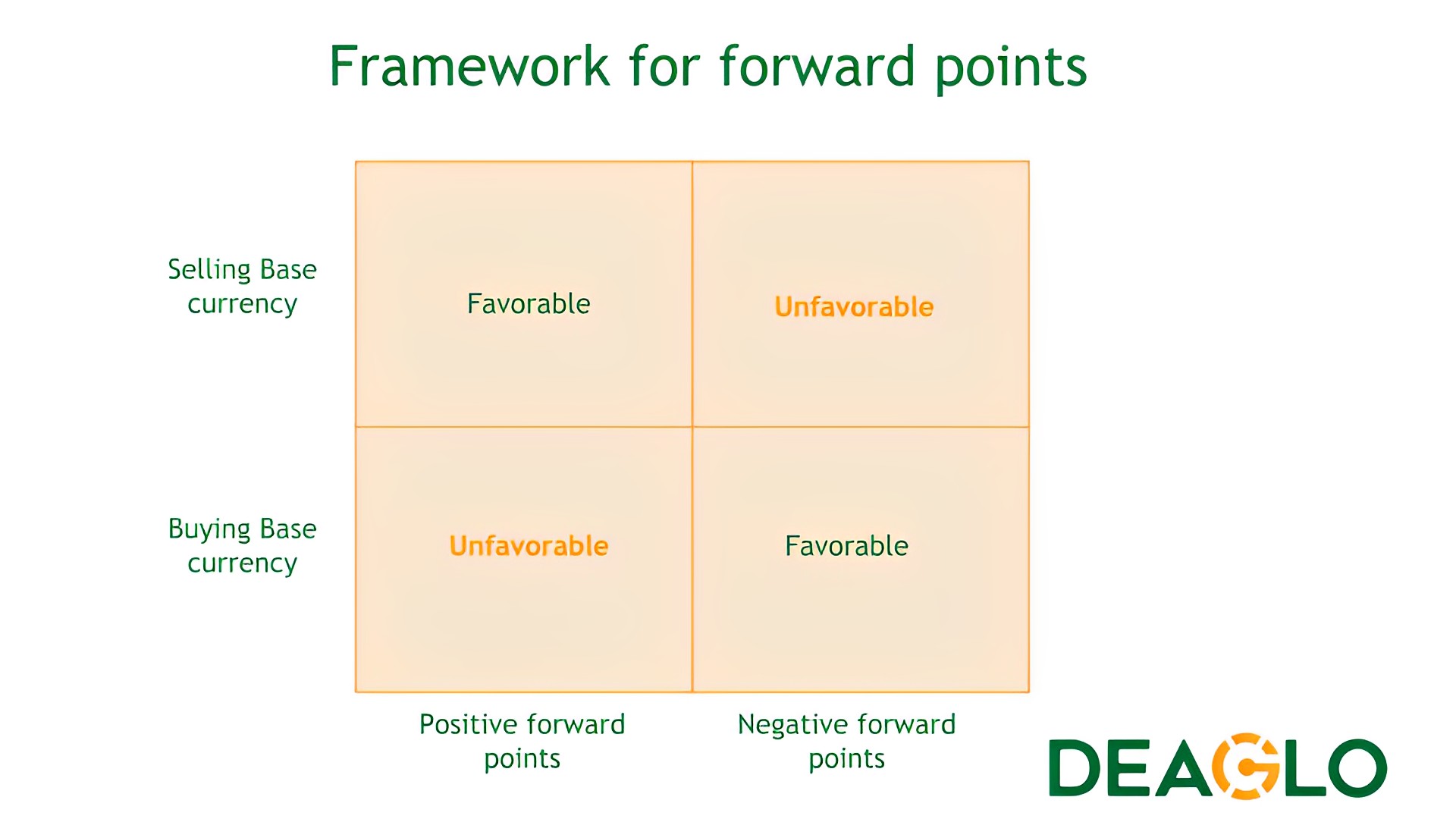

Depending on which currency is bought or sold, the forward points can be favorable or unfavorable to the hedger.

A general framework to understand the effect of forward points is presented in figure 1.

Figure 1, Source: Deaglo

Note: (If the difference between the spot and the forward rate is small, then it doesn't matter. However, sometimes the difference is material)

Using this paradigm, one can determine whether or not the FX Forward contract is favorable to the hedger. However, there are limited resources to understand how much it is favorable to the hedger.

As a result, It becomes difficult to decide whether or not to hedge without quantifying.

And this is where the Deaglo FX platform's "Forward Efficiency Tool" comes in handy.

Introducing the simple and ultimate way of valuing a forward contract.

2. Forward Efficiency Tool

The Deaglo FX platform's Forward Efficiency Tool is intended to show how much the FX Forward contract favors the hedger. It measures the efficiency of the forward contract or, in other words, an ultimate way of valuing a forward contract.

How does it work?

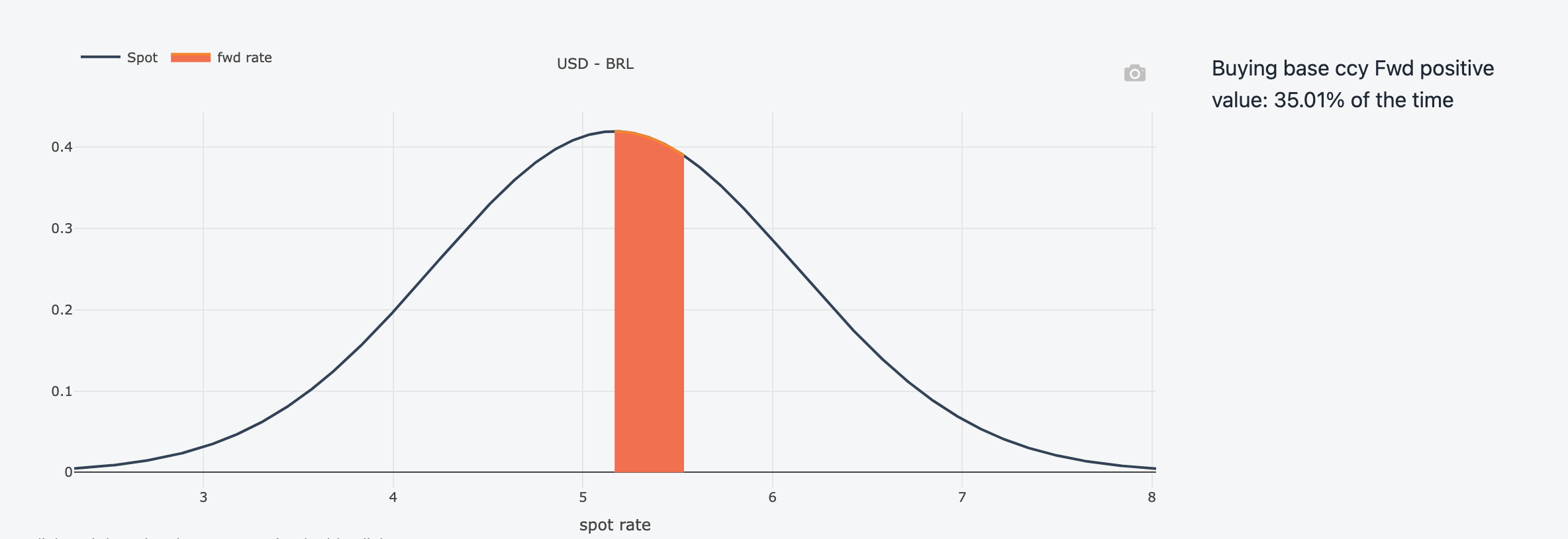

The Forward Efficiency Tool uses currency pair volatility to create a probability density curve (a standard curve) around the spot rate. It plots the forward rate curve, which may be less than or greater than the spot rate.

Ultimately, it shows how long (as % of the time) the forward would benefit the hedger throughout a transaction.

Let's understand it with an example.

Plotting the forward curve for USDBRL for one year shows that the forward rate is higher than the spot rate. (Check figure 2)

Figure 2, Deaglo FX Platform: Forward Efficiency Tool

Note: (In this case, the large red area shows the percentage of time the forward is unfavorable to the hedger. The forward is only favorable to the right of the red area)

In this example, the transaction involves selling BRL or buying USD. As per the graph results, the forward would protect the hedger only 35% of the time, implying a greater chance that the hedging would be unfavorable to the BRL seller. Hence, it's better to go unhedged.

On the other hand, if we consider buying BRL or selling USD, let's see the results.

Figure 3, Deaglo FX Platform: Forward Efficiency Tool

Note: (the green area shows the percentage of the time the forward is favorable to the hedger.)

Here, selling USD or buying BRL adds value to the transaction approximately 16% of the time. Therefore, placing a hedge gives a chance of upside potential.

Such a quantification presents a data-driven approach regarding whether or not to hedge an international investment/transaction.

Finally, the Forward Efficiency Tool can be applied to any foreign transaction to compute the efficiency of an FX forward contract.

Hence, this simple yet powerful feature demonstrates the true value of a forward contract in a specified foreign transaction.