To coin a phrase from our CEO Ashley Groves,

"FX Hedging at funds is often the proverbial buck, with responsibility passed back and forth between the fund manager and investor."

The lack of decisiveness surrounding FX risk management is often attributed to the fact that many institutional investors deem it to be a complicated process and quite frankly, an unnecessary expense.

However, with market volatility incredibly high, combined with globally low-interest rates, obtaining the right FX hedging strategy to mitigate foreign exchange risk could be the difference between losing a lot of money and boasting outsized returns.

This article's purpose is to help you understand the true value of an effective FX hedging strategy, specifically pertaining to fund IRR, and to provide you with the key insights to get stakeholder buy-in.

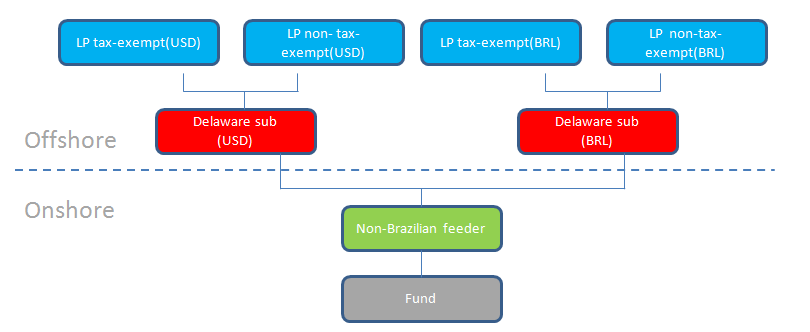

Although proper structuring takes care of taxes and the segregation of funds, offshore investors have an additional consideration - the mitigation of foreign exchange risk. Investment funds often accept investments from offshore as well as domestic investors. This is especially prevalent when the fund is domiciled in an Emerging Market country, where returns often exceed that available in OECD countries. The funds are structured to optimize tax treatments and silo returns properly.

Fig 1 shows how a Brazilian fund might structure legal entities to accommodate a USD share class.

Fig 1

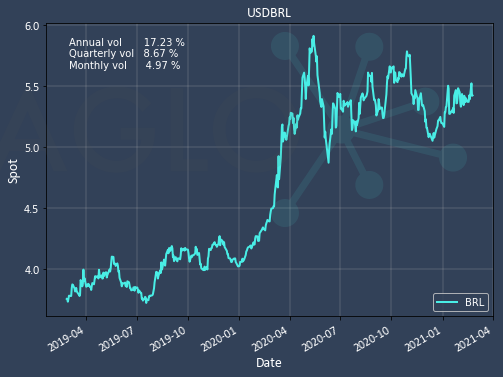

When a US investor decides to invest offshore, his dollars must be converted to local currency (for example, reais in Brazil). After the investment matures and distributions are made, the reais are converted back to dollars for this investor. Given that the annual volatility of USDBRL is currently about 17%, the potential for extraordinary losses is obvious (see Fig 2).

Due to this high volatility, offshore investors may demand that the foreign exchange risk be mitigated as a condition of their participation. While EM countries often offer high returns, many EM currencies have experienced a dramatic depreciation against the majors over the last 3 years, negating those returns.

Examples include:

- ZAR (-25%)

- BRL (-45%)

- COP (-22%)

- CLP (-25%)

Additionally, the volatility of these currencies is extremely high, reducing the Sharpe Ratio of the investments. Reducing volatility through FX hedging improves the Sharpe Ratio significantly, highlighting how effective of a solution it can be.

Fig 2

Hedging the FX risk is definitely prudent, and as previously mentioned, it improves the Sharpe Ratio. However, there are still often valid concerns regarding how hedging costs can impact returns (in particular, IRR). We will now show how a properly-structured effective hedging program can manage FX risk with minimal IRR impact, diminishing this concern.

Where is the Investor exposed to FX risk?

First of all, we’ll investigate how an investor is exposed to foreign exchange risk, using a typical investment scenario. In this case, an investor commits to a total level of investment, which is cash called over time, i.e. a waterfall. This deployment in-country over a period of many months to several years, means the investor's currency will be converted to the fund's currency at different rates.

In our example, this currency conversion would be USD to BRL. The risk present during this phase is that an appreciating BRL reduces the amount of local currency that the USD investor acquires in the fund.

After the initial investment tranches begin generating returns in local currency (typically several years later), the harvesting phase begins. The returns are converted back to the investor's home currency before distribution (BRL to USD). This phase may also last several years. The FX risk during this phase is that a depreciating BRL reduces the amount of USD the investor receives.

So what are the issues with FX hedging?

Hedging FX is most often done using derivatives such as forwards or options (natural hedges are typically difficult to identify in these scenarios).

There are several factors that need to be considered:

- Extremely long tenors of the investment cycle can create challenges. Typically, banks or MSPs (Money service providers) are reluctant to offer tenors longer than 2 years, particularly when an EM currency is involved. Option tenors are even more limited.

- Forward points can be very high in EM currencies. For example, a USDBRL NDF for one year is 2.6% and USDZAR is 4.6% (Bloomberg, 1/19/21).

- Because EM currency pairs often exhibit high volatility, options (which are priced from implied volatility) are impractically expensive for any but the shortest of tenors.

- High volatility can create large Mark-to-Market (M2M) swings, triggering margin calls.

- In some countries, the central bank currency controls may set rules and limits on the rates at which derivatives are valued. For example, the Banco do Brazil sets a daily "PTAX" rate. This can create basis risk for rolling hedge strategies.

As a result of these factors, the most effective hedging strategies seek to minimize volatility over the long run. There are, however, three techniques used to combat this:

1) Round-trip hedging

Attention is most often paid to local currency depreciation during the harvest phase. In our previous example, this would be BRL weakening against USD. However, this is the hardest and most expensive phase to hedge simply because it has the longest tenors and forward points are against the hedger.

If the deployment phase is also hedged, BRL appreciation risk is mitigated and forward points will generate a positive return of several percent. This positive return offsets to a large extent the costs of hedging the harvest phase. It's a win-win because both the total risk and the overall cost of hedging are reduced.

2) Layered hedging

Utilizing a "fire and forget'' hedge strategy is simple to implement. All it requires is entering into forward contracts for every forecast deployment and/or harvest cash flow. However, this approach has various disadvantages:

- The current rate may be disadvantageous or anomalous.

- The hedger cannot respond to changing market conditions (and they will definitely change over 4-5 years!)

- Forecasts that distant are impossible to predict accurately.

So how do we alleviate all of these problems? Well, utilizing a layered strategy whereby fractions of the exposure are hedged periodically will do so, as well as offering a vastly-reduced effective volatility.

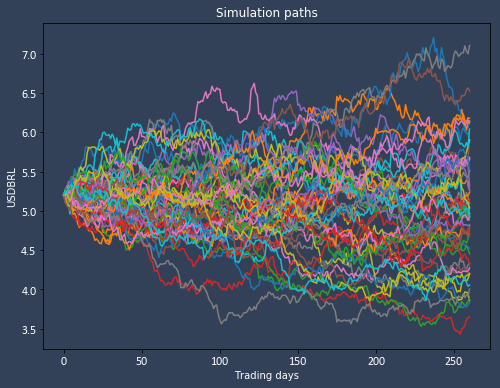

3) Monte Carlo Margin Determination

Closed funds do not like to hold back cash for purposes of meeting margin calls - it reduces the deployed capital and lowers returns. All derivatives except purchased options will usually require some level of initial and/or variation margin. Therefore, optimizing the level of funds held back to meet these margin calls is material - if too little is held back, then the investors may be cash-called, in other words, not a good scenario! If too much is held back, returns are reduced.

Using Monte Carlo techniques allows us to determine the optimal level of margin. Thousands of potential market scenarios are modelled, using desired levels of volatility and kurtosis (fat tails) - see Fig 3.

Fig 3

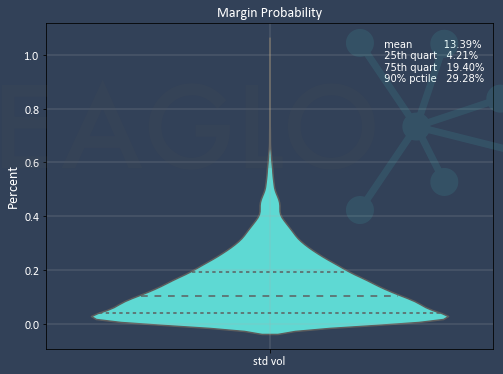

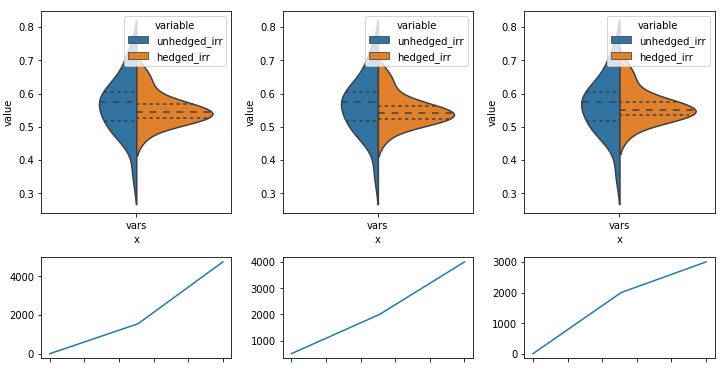

For each path, a distribution of margin calls can be generated and displayed (here using a violin plot in Fig 4). The Expected Value can then be used to determine the optimal level of margin cash to be held back.

Fig 4

Hedged vs. Unhedged IRR

So in utilizing these three best practices, what is the expected effect on hedged IRR and how does it compare to unhedged?

There are many factors that influence both hedged and unhedged IRR (irrespective of the actual investment itself):

- Forward points during deployment and harvest.

- Margin drag (reduction of deployed capital and the resultant loss of returns on it).

- Spot path during both phases.

There is no closed-form solution to this calculation, so a Monte Carlo simulation was set up to measure the effects on IRR. The spot path is generated with a Geometric Brownian Motion model, with controllable volatility and skew. The forward curve will definitely change as the relative interest rates are modified by the two relevant central banks, so the simulation is run across three different scenarios.

Simulation assumptions include:

- Forward points were evaluated over three different scenarios (current, steeper, shallower)

- Skew (market trend) was kept at zero.

- For the unhedged IRR, only the spot path has an effect. For the hedged IRR, all three factors have an effect.

Fig 5 shows the results of the simulation under nominal volatility. Note that the hedged IRR only differs from the unhedged IRR by a few percent. While not always the case, this is likely due to the fact that the round-trip hedging produces a small profit during deployment (favorable points hedging USD -> BRL) and that those profits come before the harvest costs from unfavorable points. The profits are therefore discounted less than the costs in the IRR calculation.

Much more importantly, the unhedged IRR distribution is far wider, with a worst-case IRR of .25. The interquartile range is from .52 to .62. The hedged IRR distribution is far narrower, reducing the downside risk by a substantial margin. In fact the 25th and 75th quartile range is about half that of the unhedged IRR, ranging from .53 to .57 (less than half the volatility). Thus, the hedged IRR is much more predictable and reliable, at a minimal cost.

Fig 5

Conclusions

Often, fund managers make the assumption that hedging FX risk will be too costly and will negatively affect their IRR and other performance metrics. While the results in this BRL investment example may not extend to other EM currencies with much higher hedging costs, we have shown that following best practices (round-trip hedging, following a layered strategy, and optimizing margin) can mitigate these effects and offer the fund manager peace of mind when it comes to their FX risk.