Currency fluctuations affect the cost competitiveness, profitability, and valuation of a company's international operations. Although many companies are aware of the currency risk and its negative impacts, they refrain from creating a Foreign Exchange (FX) Risk Management Strategy, leaving the company unprepared when it comes to controlling the potential adverse effects of currency movements.

Overall, global corporations and fund managers are facing increased currency risk in recent years across all currencies after the world was hit by the Covid-19 pandemic, and although global economic recovery is taking place, challenges continue to persist, including the current energy crisis, geopolitical conflicts, and political instability.

HOWEVER, THERE IS NO NEED TO PANIC - In times of uncertainty, it is important to remember that you can only control what you can control, and having an effective FX risk management strategy can help alleviate a lot of the anxiety when transacting overseas.

In this article, we will explain how our technology helps to quantify and analyze such FX risk, as well as describe the tools and approaches that we use to hedge and manage these FX risks.

FX Risk Management Strategy Checklist

- Quantify my FX Risk

- Setting my worst-case scenario rate

- Understanding the derivatives tools available

- Selecting my FX strategy through simulation

- Calculating the cost of your FX strategy

- Achieving best execution

- Managing my ongoing FX exposure

Step 1 - Quantify my FX Risk

The first step in managing FX risk is quantifying it. Is it material? Will it harm my business or investors? One of the most common measures is Value at Risk (VaR). VaR is an attractive measure because it is easy to understand. In essence, it asks the simple question - ‘‘How bad can things get?’’.

In other words, the VaR states the maximum possible loss at a given confidence level. For example, a VaR of $3M means that 90% of the time your losses will not exceed $3M in a one-month period.

How do you calculate VaR?

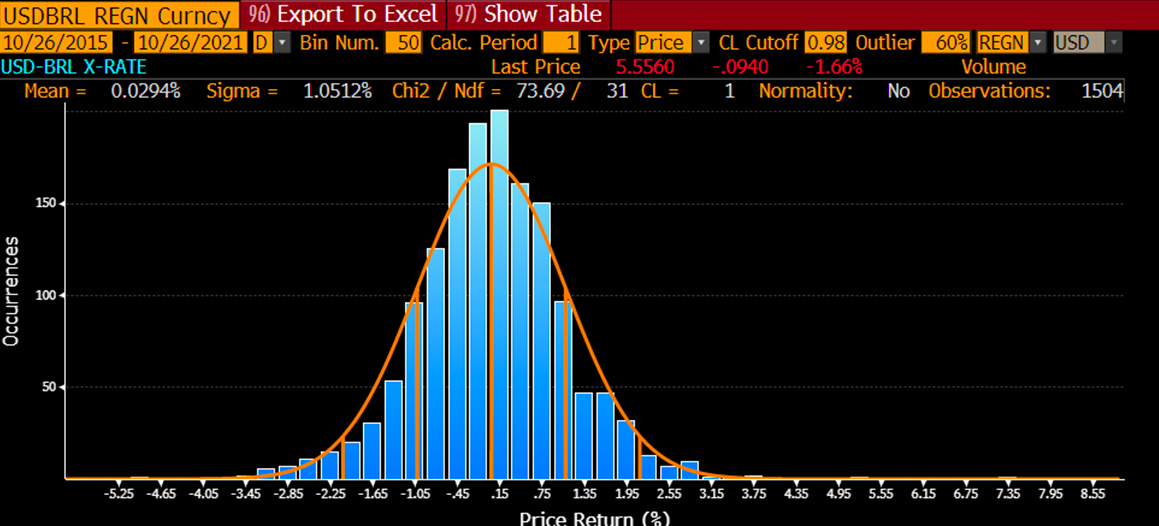

Assuming that market returns are normally distributed (Fig. 1), you can use the volatility of the historical market returns to calculate your VaR. Historical simulation is one popular way of estimating VaR. It involves using past data as a guide to what will happen in the future.

Figure 1. Example of a normal distribution

Using Excel:

- Populate a column with daily historical spot values.

- In the next column, calculate the log returns (which will help normalize the data).

- Use the Excel function stdev(log returns) to calculate the standard deviation (= volatility).

- Convert this daily volatility to monthly by multiplying by sqrt(21).

- Finally, using the Excel function normsinv(90%), calculate the number of std deviations of the desired confidence, multiply by the volatility and the size of the exposure.

The result is the month VaR (Fig. 2). Figure 3 illustrates the VaR in the probability distribution chart.

Figure 2. Calculating VaR on Excel

Figure 3. Calculation of VaR from the probability distribution of the change in the currency value; with a confidence level of 90%.

Step 2 - Setting my worst-case scenario rate

Most firms will have set a “Budget Rate” (aka planning rate), which is a conservative estimate of the future exchange rate. It’s used to set prices in local currency and estimate future revenues or returns in the firm’s reporting currency. Depending on the firm’s margins or expected returns, an additional buffer may be added. This is the rate that needs protecting - if it’s breached, the risk manager will experience liquidity problems. This is where hedging is useful. A budget rate should be achievable through hedging.

Reminder: Your main responsibility is to your shareholders, and you are paid to import widgets, grow revenues or provide investment returns. Currency speculation is unlikely to be a part of your strategy. Outperformance is welcomed, but generally not the policy objective.

Step 3 - Understanding the derivative tools available

You've decided to use hedging to protect your firm or investors. There are many instruments and methodologies to choose from.

FX hedging Instruments include:

- Forwards

- Futures

- Options

- Long-term debt instruments

- Cross-currency swaps

Each has advantages and disadvantages, and the choice depends on both the firm's risk profile and margins. What’s more, you will need to get buy-in from either your board, shareholders, investors, or all of the above, so it probably makes sense you understand them.

Need some help? Talk to an expert today.

Step 4 - Selecting my FX strategy through simulation

Not managing FX risk, results in speculation, pure and simple. Hope is not a strategy and betting the firm on some Fibonacci retracement is equally unwise.

Multinational corporations and global fund managers are facing increased currency risk as volatility has significantly increased in recent years across all major and exotic currencies after a prolonged period of relatively range-bound activity. CEOs, CFOs, finance teams, and corporate boards continue to face scrutiny from stakeholders and investors regarding the effectiveness of risk management policies to mitigate currency risk and protect shareholder value.

We can act as a valuable partner during times of uncertainty. Organizing and presenting the facts in a clear and concise way can help speed up the decision-making process by removing the emotion out of a stressful situation.

Figure 4. Strategy selection and comparison

Our technology can help with hedge product selection and evaluation (Fig. 4). Our Monte Carlo engine technology can simulate not only a normal market, but one with elevated volatility, fat tails, and even a skewed up or down option. Evaluating strategies against many market scenarios, and displaying the results in an easy-to-understand graphical manner, makes it easy and intuitive to select the best strategy and communicate the reasoning to C-suite and investors.

Moreover, we will provide you with a full explanation of hedging products, the benefits, drawbacks, costs, and so on. All the details you need, for you to make the right decision.

Step 5 - Calculating the cost of your FX strategy

When discussing hedging costs, we need to make a clear distinction between hedging impact and trading costs.

Hedging impact

Here, we are discussing the cost related to the interest rate differential (put simply, forward points), which can either incur a carry cost at the inception of the hedge or a credit.

For instance, using forwards when both currencies are major (e.g. GBP, USD, EUR, CAD, AUD, NZD, CHF) are essentially free. Forward points are currently almost zero. If one or both of the currencies are in an emerging market (e.g. BRL, INR, MXN), then the annual cost might reach over 8% annually (Fig. 5).

Figure 5. The forward curve for the USDBRL

Trading costs

Trading costs can be defined as the bid-ask spread that is earned by the counterparty or financial institution on the other side of the trade. For instance, when entering into a forward contract, you need to make sure both the spot rate and the forward points or interest rate differential between the two currencies are priced appropriately.

Other trading costs include the collateral required to protect parties to a contract in the event of default by the other counterparty. When trading standardized derivatives, you will be required to post the initial margin and variation margin with the counterparty.

Thus, initial margins and variation margins are two types of collateral required to protect parties as mentioned earlier.

In this sense, an unexpected negative variation margin of positions may introduce new risks to the company's cash flow. This is often accompanied by the need to post financial deposits (this requirement is also known as margin call) to cover negative positions, directly impacting the availability of the company's financial resources.

Unexpected variation margin payments can definitely frighten organizations off. Although it is not possible to eliminate 100% of the possibility of margin calls (except for long options), there are statistical tools that companies can adopt to estimate the likelihood of the occurrence of inconvenient margin calls in advance.

By using the Monte Carlo simulation (Fig. 6), our technology can model the probability of different outcomes in a situation that cannot easily be described in a closed-form equation. It is often used to understand the impact of risk and uncertainty in prediction and forecasting models.

Figure 6. Monte Carlo simulation

Once you have determined the optimum hedge strategy, the variation margin model can assess the moneyness for every derivative in the selected strategy (forwards, options, exotic options, etc.). Therefore, using a variation margin model that shows the likelihood and levels that will trigger these requirements, will substantially help companies plan and optimize funds to meet any margin calls.

Over the years, besides our Margin Call Simulation tool, our team established relationships with a number of execution partners. These relationships, their preferential transaction rates, and 0% credit facilities* are extended to our clients, regardless of the transaction size or annual volume. This ultimately substantially reduces the time spent on unnecessary vendor selection.

We empower finance and investment teams with tools needed to effectively transact overseas, allowing you to focus on your core business strategy.

*0% facilities are based on an entity’s financials and are looked at on a case by case basis. Deaglo has successfully negotiated a number of 0% facilities for our clients but it cannot be guaranteed and is subject to the banking provider's risk appetite.

Step 6 - Achieving Best Execution

The general understanding of best execution is usually narrowed to achieving the best price. The truth is that, when engaging in FX, corporations and fund managers end up facing other risks by controlling the exposures.

As CFOs are driven by the best price, the most competitive counterparty earns the majority of FX exposure, which by default increases the counterparty risk and the liquidity at risk of breaching the thresholds of a specific FX line.

A way to bring balance into the equation (Fig. 7) and ease the pressure of chasing best price and understanding Best Execution in a holistic way, is to pre-define with counterparties Fixed Spread agreements that guarantee fair pricing and cost control amid the broader terms of the FX trading facility.

Figure 7. Best execution equation

Step 7 - Managing my ongoing FX exposures

If you have made it this far, you might have figured out that all these steps mentioned above are crucial and must be considered when establishing an FX Risk Management Policy.

This document is important for several reasons. First, it provides a framework and guideline for management to analyze, measure and hedge for FX risk. A policy also provides guidance to new team members in an organization and educates them on risk management and the corporation's philosophy on hedging.

We help clients to formalize the hedging process and provide a road map for those involved in the process, thereby strengthening controls and providing management with the framework to identify, analyze, and hedge for FX risk in accordance with the organization's risk tolerance level.

Our Clients are aware that an effective hedge program is not static, just as a company's financial and business risks change. As you grow and become more dynamic, it is necessary for a hedging program to change and adapt as well.

We add value to our clients by negotiating on their behalf the commercial terms of their FX trading facilities, including the agreement of fixed spreads ensuring that on an ongoing basis these are delivered in a reliable and transparent fashion.