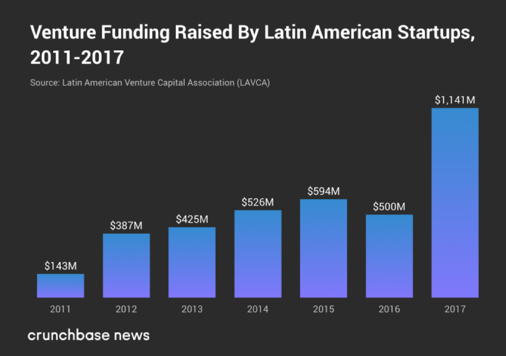

Venture funding in Latin American startups is up from previous years. LAVCA estimates that Private Equity (PE) and Venture Capital (VC) fundraising together in Latin America in 2017 totaled $4.3 billion, up from $2.3 billion in 2016. Brazil led the region across all stages of VC investment, capturing 73 percent of VC investment dollars in 2017 and the first half of 2018 (201 startup investments totaling $1.4 billion). Mexico was the second most active market by number of deals (82 startup investments totaling $154 million), but Colombia saw more money invested ($188 million over 23 deals). See fig 1.

Fintech is the top sector of VC investment by dollars and number of deals in Latin America. The region also hosts a number of unicorns, including Brazilian ride-hailing startup 99; Colombian last-mile delivery service Rappi; Brazilian learning systems provider Arco Educação; and Brazilian fintech startup Stone Pagamentos.

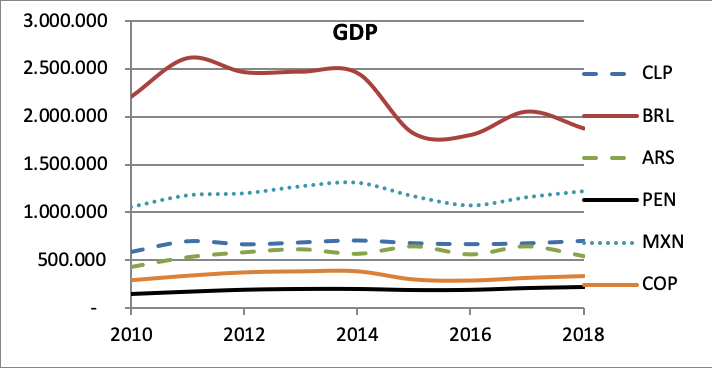

Whilst Brazil has the largest economy, and led investments in 2017/18, the economy has been on a shrinking trajectory since 2014, whereas Mexico has been on a gradual growth path.

Unemployment shows the changing fortunes of Mexico and Brazil even more clearly, and the growing pain of Argentine since late 2014. Chile and Columbia are the dark horses here, with falling and/or stable unemployment at reasonable levels.

By country:

Argentina

With a Gross Domestic Product (GDP) of more than US$500 billion, Argentina is one of the largest economies in Latin America. Argentina has vast natural resources in energy and agriculture. Within its 2.8 million square kilometers of territory, Argentina is endowed with extraordinary fertile lands and has great potential for renewable energy. It is a leading food producer with large-scale agricultural and livestock industries. In addition, Argentina has significant opportunities in some manufacturing subsectors, and innovative services in high tech industries. Urban poverty in Argentina remains high, approximately 50 percent higher than in new HICs countries and almost two times that of OECD countries. The incidence of poverty reaches 41% among children up to 14 years old. Financial turbulences in 2018 led to a 50.6% depreciation of the Argentine peso and implied the revision of the economic plan and a US$57 billion agreement with the International Monetary Fund (IMF) until 2021, which includes a strong reduction of expenditure. In 2018, the government met its fiscal objectives and aims to achieve the primary fiscal balance in 2019 and a primary fiscal surplus of 1% in 2020.

The economic context is increasingly volatile. After a fall of 2.5% of GDP in 2018, a contraction of 1.3% is expected for 2019. With annual inflation of over 50% (the highest level since 1991), the Argentine peso regained volatility and depreciated more than 13% during 2019. Argentina's economy contracted by 5.8% in the first quarter of 2019, after shrinking 2.5% last year. Three million people have fallen into poverty over the past year. In August, the government restricted foreign currency purchases and is now seeking to defer debt payments to the IMF. President Macri (a reformer), is likely to be ousted in October and replaced by left-wing candidate Fernandez.

Industries: food processing, motor vehicles, consumer durables, textiles, chemicals and petrochemicals, printing, metallurgy, steel

Brazil

Brazil experienced a period of economic and social progress between 2003 and 2014, when more than 29 million people left poverty and inequality declined significantly. In the wake of a strong recession, Brazil has been going through a phase of highly depressed economic activity. The country's growth rate has been slowing since the beginning of the decade, from an annual growth rate of 4.5% (between 2006 and 2010) to 2.1% (between 2011 and 2014). There was a significant contraction in economic activity in 2015 and 2016, with the GDP dropping by 3.6% and 3.4% (respectively).

Industries: textiles, shoes, chemicals, cement, lumber, iron ore, tin, steel, aircraft, motor vehicles and parts, other machinery and equipment.

Chile

Chile has been one of Latin America’s fastest-growing economies in recent decades thanks to a solid macroeconomic framework. The economy rebounded in 2018, growing at a rate of 4 percent. This improvement reflected more private-sector confidence, lower interest rates and higher copper prices, which revitalized mining production. Non-mining activities, particularly wholesale trade, commercial services and manufacturing also progressed. The current account deficit increased from 2.2 percent of GDP in 2017 to 3.1 percent in 2018 thanks to growing capital goods imports and net foreign assets. This deficit was mainly financed by increased foreign investment, which enabled international reserves to remain stable. The central government debt declined for the first time in six years, from 2.7 percent of GDP in 2017 to 1.7 percent in 2018 due to increased revenue.

industries: copper, lithium, other minerals, foodstuffs, fish processing, iron and steel, wood and wood products, transport equipment, cement, textiles

Columbia

Colombia has been receiving a massive and accelerating inflow of migrants, from Venezuela, with approximately 1.2 million Venezuelans having arrived in Colombia as of September 2018 with the intention to stay. Economic growth decelerated gradually to an estimated 1.4 percent by 2017, before reaccelerating to 2.7 percent in 2018, with the soft-landing supported by sound macroeconomic policies and structural reforms undertaken in recent years. Growth is expected to strengthen at a moderate pace over the 2019-2021 period, as private consumption growth continues to accelerate, and investment spending is boosted by lower effective corporate taxes. Accommodative monetary policy and improved confidence will also support growth. Higher profitability in the oil sector is expected to incentivize investments in exploitation and exploration. A larger number of financial closings for the 4G projects and a pick-up in execution of existing projects augurs well for investment over the 2019-2020 period.

industries: textiles, food processing, oil, clothing and footwear, beverages, chemicals, cement; gold, coal, emeralds

Mexico

Mexico is the second largest economy in Latin America. The Mexican economy expanded at a modest pace of 2% annually during the first half of 2018, below its potential growth, as uncertainties around North American Free Trade Agreement (NAFTA) renegotiations and the past Presidential elections weighed on investment. With the elections behind, and the trilateral US-Mexico-Canada Agreement (USMCA) on trade, past uncertainty factors should fade, helping to support a further, albeit moderate, rebound in investment. The incoming administration’s economic team signaling its commitment to prudent fiscal and monetary policies.

industries: food and beverages, tobacco, chemicals, iron and steel, petroleum, mining, textiles, clothing, motor vehicles, consumer durables, tourism

Peru

Between 2002 and 2013, Peru was one of the fastest-growing countries in Latin America, with an average GDP growth rate of 6.1 percent annually. A favorable external environment, prudent macroeconomic policies and structural reforms in different areas created a scenario of high growth and low inflation. The strong growth in employment and income sharply reduced poverty rates. Between 2014 and 2017, GDP growth slowed to an average rate of 3.0 percent, mainly owing to the decline in international commodity prices, including copper, the leading Peruvian export commodity. This led to lower private investment, less fiscal income and weak consumption. Two factors attenuated the impact of this external shock on GDP, enabling continued growth, albeit at a slower pace. The first was the prudent fiscal policy management in terms of monetary and exchange policies. Second was the surge in mining production as projects implemented during the boom years matured, which increased exports and offset the deceleration in domestic demand. In this context, the current account deficit diminished rapidly, from 4.8 percent of GDP in 2015 to 1.1 percent in 2017. Net international reserves remained stable at 27 percent of GDP in August 2018. Average headline inflation was 2.8 percent in 2017, within the Central Bank’s target range.

industries: mining and refining of minerals; steel, metal fabrication; petroleum extraction and refining, natural gas and natural gas liquefaction; fishing and fish processing, cement, glass, textiles, clothing, food processing, beer, soft drinks, rubber, machinery, electrical machinery, chemicals, furniture

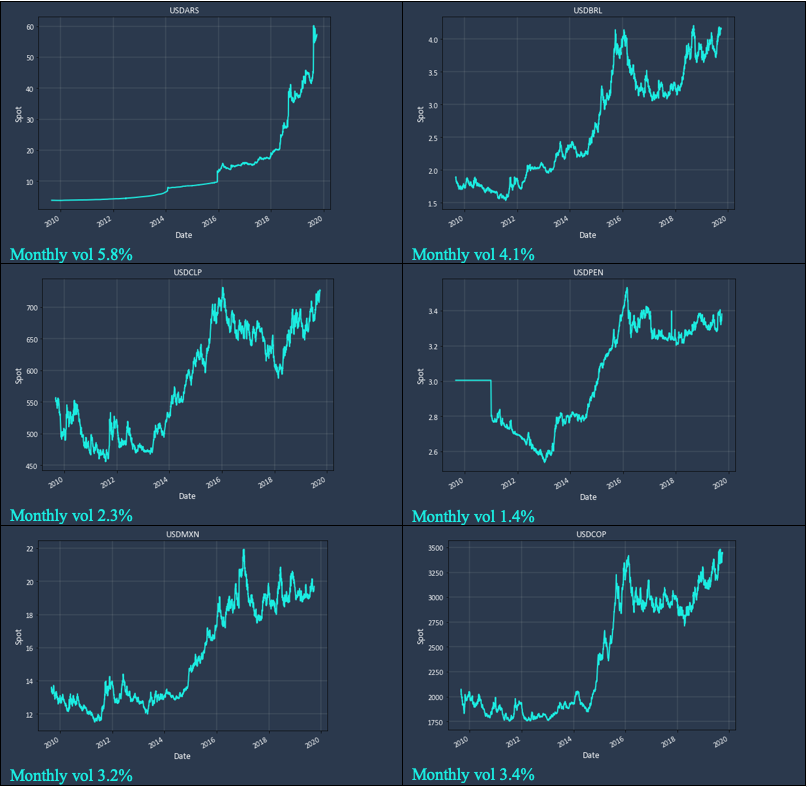

Historical currency movement

Managing FX risk

For many of these currencies, forward points are very high. If purchasing the LC forward, this is to the hedgers advantage, but the normal situation is selling the LC forward after a period of investment. This puts the hedger at a disadvantage.

For example, selling MXN forward one year against the USD incurs a 6% cost in forward points. BRL and ARS are also very expensive. A few currencies, like the CLP (Chilean peso) have very low points, enabling normal hedging paradigms.

If using forwards is the hedge of choice, and the direction is selling LC forward, analysis of the forward curve gives an indication of whether to hedge each month individually (ie longer tenors), or whether to roll the entire amount monthly. In the figure below, it's clear the curve bends upwards, making longer tenors relatively more expensive than shorter tenors. For the BRL then, keeping tenors short and rolling them monthly is the least-costly strategy.

For currencies like MXN and BRL with exorbitant hedging costs, an alternative exists- proxy hedging. Proxy hedging has its challenges. It is very difficult to identify a single currency proxy with a useful level of correlation. When the correlation is poor, the portfolio variance and basis risk will be high. Using a "basket" of three to four proxy currencies can improve performance. However, common practice using linear regression) has produced mediocre results and unnecessary basis risk.

New machine learning algorithms such as Ridge and Bayesian Regression overcome many of the limitations of the traditional approach. They are less sensitive to noise, less likely to over-fit, and make the most of available data (through train/test splits and k-fold cross validation). They are computationally intensive, but produce excellent results.

Figure 7 shows the results of using a basket of currencies to hedge the CLP. As can be seen, the correlation is quite high.

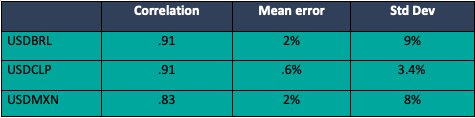

Table 1 shows some highlights of that testing across LATAM, African and eastern European currencies:

The relatively high standard deviation requires a careful calculation of hedge ratios using the proxy to achieve the lowest portfolio variance.

Conclusion

Many LATAM countries present attractive, growing economies and investment opportunities. However, the volatility of exchange rates, and often high hedging costs mean that a considered approach to hedging FX risk is required.

If you are contemplating investing in Latin America and would like help analyzing the costs and your hedging options. Please reach out to us HERE or book a meeting using the button below.