Jive used a Hedged Share Class to successfully raise capital from US LPs

The Client

Jive Investments "the client" is an integrated alternative assets platform that focuses on the origination, acquisition, and recovery of non-performing loans (NPLs), distressed real estate properties, legal claims, and other distressed assets in Brazil.

Jive was confident that they would be growing the share class substantially for their new Fund III and were interested in looking at alternative hedging products to help market to the growing US investor community.

Jive had garnered sufficient interest from USD-based LPs that warranted them opening a USD share class. Thus, Jive has offered both a hedged and unhedged share class to offer offshore investors the means to reduce the potential impact of the Brazilian Real fluctuations on their investment returns. The Jive's fund is a BRL-denominated fund with investors committed in USD (U.S. dollars).

Key Takeaways

An appreciating BRL reduces the amount of local currency that USD commitments from international investors could purchase or acquire.

A depreciating BRL reduces the amount of USD that foreign investors will receive when realizing proceeds, receiving less capital back.

Methodology

- Objective of the USD-Hedged Class

Jive's USD hedged share classes aim to provide international investors with a return correlated to the Brazilian Real performance of the fund, by reducing the effect of exchange rate fluctuations between the BRL and hedged USD share class.

- Derivative-Based Hedging

Jive attempts to minimize the variance in returns to hedged investors using a variety of derivatives instruments, including options, forwards, NDFs, and Swaps. For that, Jive is supported through statistical analysis and complex computational techniques (i.e. Monte Carlo simulation), powered by Deaglo to facilitate an informed decision from Jive.

- Layer Hedging Methodology

Jive’s implemented hedging strategy consists of hedging fractions of each capital call and harvest forecast before the effective distribution of the capital – Layer Hedging Methodology.

- Investor Protection and Return Stability

The Hedged Share Class has been capable of shielding investors’ returns against currency fluctuations that can result in substantial losses. Thus, it allows GPs to reduce considerable uncertainty regarding the performance of a fund.

Results

- Strategy Comparison

Jive has been using complex computational techniques to decide between multiple hedging strategies (e.g. NDFs, single option, collars, par forwards, condors, etc.).

- Hedging Impact on IRR

The Client is fully supported by simulations to evaluate the hedging impact (interest rate differential) on the targeted internal rate of return (IRR). Through Monte Carlo simulation it is possible to model changes in the interest rates between Brazil and the US and assess the risk evaluation appraisal of the interest rate differentials.

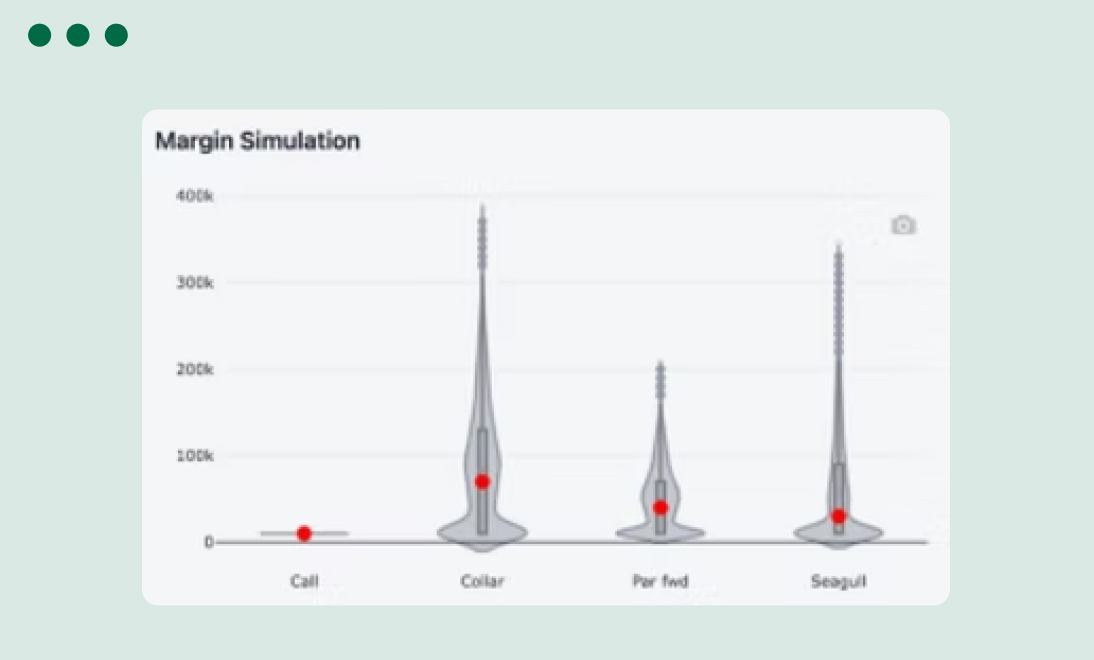

- Margin Call Simulation

Jive is also supported by Margin Call analysis to avoid margin drag. Thus, the GP can optimize the level of funds held back to meet potential margin calls due to negative Mark-to-Market in their trade positions. Using Monte Carlo techniques allows the GP to determine the optimal level of margin.