At A Glance - September 2021

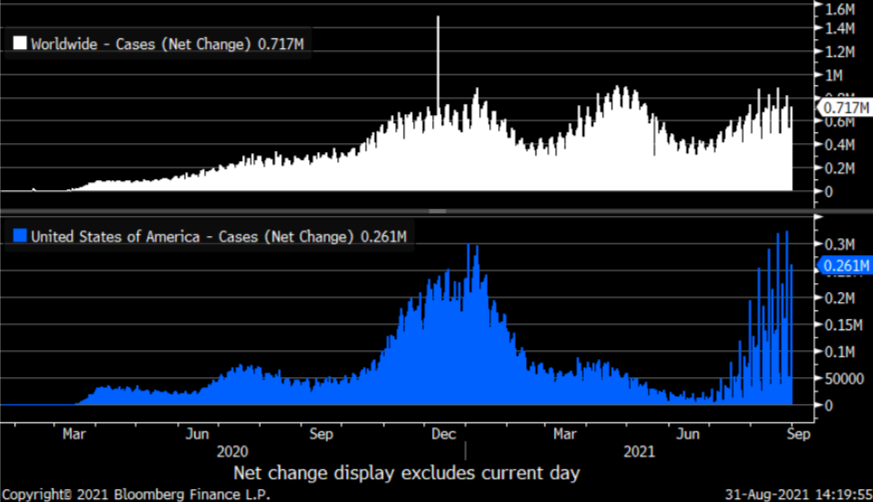

The outburst of the Delta variant kept the global markets sour through the course of a turbulent month of August. A resilient and more contagious strain of the virus has put to the test the efficiency of the vaccines and the market morale, especially after recent studies indicated that the vaccine-induced immunity fades over time, looming out the risk sentiment in global markets. The combination of i) Covid cases refusing to ease, ii) the global impact of the third wave, and iii) the uncertainty around the repercussions over the economy, has sponsored a broader appreciation of the greenback amid risk aversion.

The lingering effect of the Delta variant diminished confidence levels across the economy. The University of Michigan releases a monthly survey on consumer attitudes, representative of U.S. household's consumer confidence excluding Alaska and Hawaii. The index posted the worst readings in over a decade given the pressures arising from increasing covid cases in the U.S., in addition to market uncertainty around policymakers removing the stimulus. However, the approval of the Pfizer/BioNtech vaccines announced by the FDA, gave an additional boost of confidence as infections have mildly started to ease, while the vaccine rollout will pick up pace thanks to the rubber stamp from health authorities in the United States activating new distribution channels.

Michigan University - Consumer Confidence Index

Moreover, it is worth considering that interventions from Central Banks continue to distort and affect capital flows. The Swiss National Bank filed to the CFTC the purchase of over USD 162 billion dollars in U.S. stocks, with the intent to depreciate their own currency against the greenback. The Swiss Franc has rallied significantly due to its safe-haven appeal and it has affected the competitiveness of Swiss exports while creating a drag on the country's inflation. However, U.S. equity markets continue to flourish within the Covid chaos, building momentum aided by the deployment of Swiss stimulus and the U.S. government approving a USD 1 trillion infrastructure bill, keeping the party going for equity investors. Nasdaq and S&P 500 stock indexes rallied over 3% in August despite the sour mood, as it seems the market is running on steroids taking into consideration the different players involved.

Equity Markets - S&P 500 vs Nasdaq

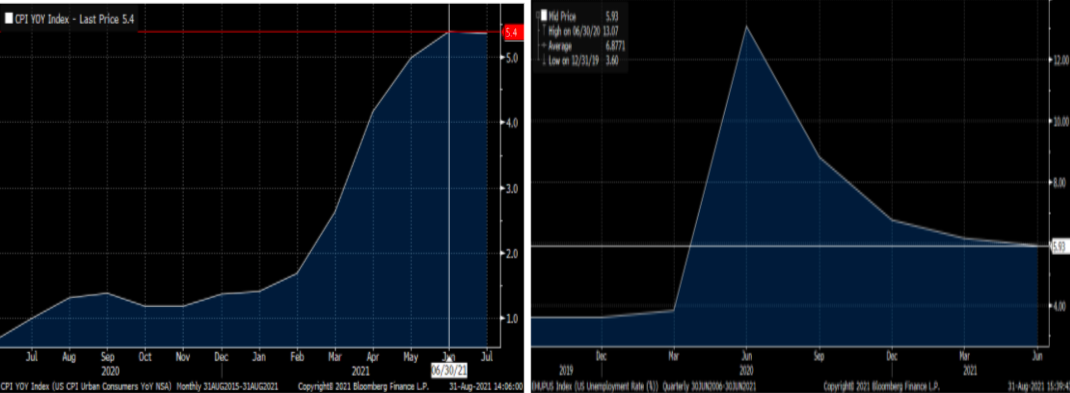

The Federal Reserve continues to support the economy through the monthly purchase of over USD 120 billion worth of bonds while keeping interest rates at record lows in an effort to reignite the economy from the impact of lockdowns and Covid measures. The stimulus program was promised to be deployed until “substantial further progress” has been made on Unemployment and Inflation. Policymakers have granted that in reference to inflation, sufficient progress has been made, ahead of unemployment, which has started to produce signs of recovery. The latest unemployment figures break the 6% mark in its latest release, posting 5.93%. However, shortages and bottleneck effects due to disruptions in the supply chain have pushed inflation higher than previously anticipated, flagging that the economy might be overheating. The Consumer Price Index has progressively picked up from 1.7% annualized in February reaching 5.4% in June and these levels have been sustained during the course of July, suggesting pressures have stabilized.

Consumer Price Index - Annualized Unemployment %

The Chairman of the Fed, Jerome Powell has constantly referred to inflationary pressures as transitory and that these are expected to ease as supply chain disruptions restore and the impact of the virus fades. Nevertheless, the sustained inflation had its own impact on interest rate hike expectation, bringing them forward after Jerome Powell firstly hinted at tapering the stimulus program back in July. Investors are now pricing interest rate hikes by the first half of 2022. As policymakers are looking at withdrawing stimulus from the economy, the resilient Delta variant seems to have finally slowed down the pace of infections by the end of August. Uncertainty and diminished market morale kept markets on the verge of their seats as jittery flows found refuge on the greenback, especially after tapering comments pushed Treasury Yields higher adding to the dollar attractiveness. The U.S. dollar index, a tool used to benchmark the greenback against a basket of six major currencies, appreciated over 2% during the first two and half weeks of August; and retracing back as tapering uncertainty faded away after the speech of Jerome Powell at the Fed’s showdown.

U.S. Dollar Index - Historical Price

The Jackson Hole Symposium had an instrumental role in the latest retracement of the greenback where we confirmed that Jerome Powell is a strong dove and we learned that he is surrounded by FOMC members shifting to a hawkish stance. Interventions from Kaplan and other Fed members supported immediate action on tapering the bond purchase program, which should start adding pressure over Powell’s reluctance to withdraw stimulus. Despite Powell defending the bank's monetary policy, there were clear indications that tapering will begin by the end of 2021 or beginning 2022.

However given the worrying circumstance and spread of the virus, he committed to easing money refraining from any immediate action. The Chairman also made a comment flagging that we shouldn’t expect interest rates to move and that those are very different topics of conversation. The dovish stance from Powell has welcomed news from market participants extending gains over the equity market while the dollar is looking to close out the month in a subdued tone. The upcoming job reports will be fundamental in order to witness an announcement of tapering in September, meaning that if Nonfarm payrolls fail to impress, we could expect the FOMC to roll its tapering decision for another month and extend further losses on the greenback.

EUR/USD

The EUR remained on the back foot against the greenback amid a broader risk-off sentiment driven by the outburst of the delta variant. The EUR fell over 1.9%, reaching prices last seen back in November. Morale indicators in the EU sustained very low levels through the course of the summer. However, macroeconomic data seems to be showing resilience although the pair failed to rally amid investor confidence.

GBP/USD

The British Pound sustained pressure against the dollar due to Covid and Brexit jitters downplaying attractive fundamentals in the economy. The outbreak of the delta variant continues to dampen the market, However, solid vaccination ratios support the Pound. Moreover, Brexit jitters keep limiting the potential of the Sterling. The latest intention to renegotiate the Northern Ireland protocol left cable in a bad place in the eyes of Brussels, while U.K. supermarkets are foreseeing shortages in the upcoming festive season.

JPY/USD

The Japanese Yen failed to benefit from its safe-haven appeal due to fundamentals failing to hold a proper grip of the outbreak of the virus due to slow vaccination rollout program. The JPY created a range where it has been oscillating throughout that course of the month and we expect renewed impetus in tapering from the Fed to break through.

CAD/USD

The Loonie had a volatile August due to the latest fluctuations in oil prices which has kept the commodity-driven currency on the move. The latest outburst of the virus required Chinese authorities to reimpose Covid measures in the country in an effort to control the Delta strain. The imposed lockdown induced global fears of a major economic slowdown and a sharp decline in demand for commodities, making WTI oil prices fall over 9% in 2 days. However, as the Chinese suspense clears, confidence and commodities prices recover, underpinning CAD.

MXN/USD

The Mexican Peso is looking to close 1.8% lower against the dollar amid greenback demand due to an increase in risk aversion and hick-ups in economic growth which kept Mexican fundamental under review. The latest GDP figures missed expectations by 0.2% on an annualized basis. The reports showed that the global index of economic activity, a proxy of GDP grew by 13.4% YoY, while it contracted 0.9% in seasonally adjusted terms compared with the previous month.

CNY/USD

The recent Covid measures dampened the market mood amid fears of a major economic slowdown. However, the Chinese economy is picking up the recovery despite the recent spread of the virus while policymakers try to incentivize the economy. The Peoples Bank of China is looking to time its expansionary policy approach with the Fed's intent to taper its stimulus program. Chinese policymakers expect to cut the Required Reserves Ratio (RRR), to keep liquidity in check.

BRL/USD

The Brazilian Real stepped back during August amid dollar strength and political turmoil in the country. Investors remain cautious as fiscal deficit and growing government expenditure from Jair Bolsonaro continues to create uncertainty among market participants. Additionally, the polemic way in which Bolsonaro has managed the Covid crisis has gained him several challenges. At the moment, the supreme court and the government are in an open campaign of impeachment which has kept markets on suspense.

For our full BRL September report, click here.

September’s Economic Calendar

USD

On Wednesday (09/01): OPC Meeting ¦ ADP Employment Change ¦ Markit Manufacturing PMI ¦ ISM Manufacturing Employment Index ¦ ISM Manufacturing PMI ¦

On Thursday (09/02): Good and Services Trade Balance ¦ Continuing Jobless Claims ¦ Nonfarm Productivity ¦ Initial Jobless Claims

On Friday (09/03): Nonfarm Payrolls ¦ Average Hourly Earnings ¦ Labor Force Participation ¦ Average Hourly Earnings ¦ Unemployment Rate ¦ Markit Services PMI ¦ Markit PMI Composite ¦

On Wednesday (09/08): Fed’s Beige Book

On Thursday (09/09): Initial Jobless Claims

On Friday (09/10): Consumer Price Index ¦ Producer Price Index

On Monday (09/13): Monthly Budget Statement

On Thursday (09/16): Retail Sales ¦ Philadelphia Fed Manufacturing Survey ¦ Initial Jobless Claims

On Friday (09/17): Michigan Consumer Sentiment Index

On Tuesday (09/21): Building Permits ¦ Housing Starts

On Wednesday (09/22): FOMC Economic Projections ¦ Fed Interest Rate Decision ¦ Fed’s Monetary Policy Statement ¦ FOMC Press Conference

On Thursday (09/23): Initial Jobless Claims ¦ Chicago Fed National Activity Index ¦ MArkit Manufacturing PMI ¦ Markit Services PMI ¦ Markit PMI Composite

On Friday (09/24): New Home Sales

On Monday (09/27): Durable Good Orders ¦ Nondefense Capital Goods Orders

On Tuesday (09/28): Housing Price index ¦ Consumer Confidence ¦ S&P/Case Shiller home Price Indices

On Wednesday (09/29): Pending Home Sales

On Thursday (09/30): Core Personal Consumption Expenditure ¦ Gross Domestic Product Price Index ¦ Personal Consumption Expenditures Prices ¦ Initial Jobless Claims ¦ Gross Domestic Product ¦ Chicago Purchasing Managers’ Index

EUR

On Wednesday (09/01): Unemployment Rate

On Thursday (09/02): Producer Price Index

On Friday (09/03): Markit PMI Composite ¦ Retail Sales

On Monday (09/06): EcoFin Meeting ¦ Sentix Investor Confidence

On Tuesday (09/07): ZEW Survey - Economic Sentiment ¦ Employment Change ¦ Gross Domestic Product

On Thursday (09/09): Gross Domestic Product s.a. ¦ ECB Interest Rate Decision ¦ ECB Monetary Policy Statement ¦ ECB Press Conference

On Wednesday (09/15): Eurogroup Meeting ¦ Labor Cost ¦ Industrial Production

On Thursday (09/16): EcoFin Meeting ¦ Trade Balance

On Friday (09/17): Current Account ¦ Consumer Price Index ¦ Construction Output

On Wednesday (09/22): Markit Manufacturing PMI ¦ Markit Services PMI ¦ Non-monetary policy ECB meeting ¦ Markit PMI Composite ¦ Consumer Confidence

On Thursday (09/23): Economic Bulletin

On Wednesday (09/29): Services Sentiment ¦ Consumer Confidence ¦ Industrial Confidence ¦ Business Climate ¦ Economic Sentiment Indicator

On thursday (09/30): Consumer Price Index - Core ¦ Consumer Price Index ¦ Unemployment rate

GBP

On Wednesday (09/01): Markit Manufacturing PMI ¦ Nationwide Housing Prices

On Friday (09/03): Markit Services PMI ¦

On Monday (09/06): Markit Construction PMI

On Tuesday (09/07): BRC Like-For-Like Retail Sales ¦ Halifax House Prices

On Thursday (09/09): RICS Housing Price Balance

On Friday (09/10): Trade Balance ¦ Industrial Production ¦ Manufacturing Production ¦ Industrial Production ¦ Total trade Balance ¦ Good Trade Balance ¦ Gross Domestic Product ¦ Manufacturing Production ¦ BoE Monetary POlicy Report Hearings

On Tuesday (09/14): Claimant Count Rate ¦ ILO Unemployment Rate ¦ Average Earnings Including Bonus

On Wednesday (09/15): PPI Core Output ¦ Consumer Price Index ¦ Producer Price Index ¦ Core Price Indexes ¦ Retail Price Index ¦ Producer Price Index - Input

On Friday (09/17): Retail Sales

On Monday (09/20): Rightmove House Price index ¦ Consumer Inflation Expectations

On Tuesday (09/21): Public Sector Net Borrowing

On Thursday (09/23): Markit Manufacturing Pmi ¦ Markit Services PMI ¦ BoE MPC Vote Rate ¦ BoE Asset Purchase Facility ¦ Monetary Policy Summary ¦ Bank of England Minutes ¦ BoE Interest Rate Decision

On Friday (09/24): GfK Consumer Confidence

On Wednesday (09/29): BRC Shop Price Index ¦ Nationwide Housing Price ¦ Net Lending to Individuals

JPY

On Wednesday (09/01): Capital Spending ¦ Jibun Bank Manufacturing PMI

On Thursday (09/02): Foreign Bond Investment ¦ Foreign Investments in Japan Stocks

On Friday (09/03): Jibun Bank Services PMI

On Tuesday (09/07): Labor Cash Earnings ¦ Overall Household Spending ¦ JP Foreign Reserves ¦ Coincident Index ¦ Leading Economic Index

On Wednesday (09/08): Current Account n.s.a ¦ Bank Lending ¦ Gross Domestic Product Deflator ¦ Gross Domestic Product ¦ Trade Balance BOP

On Thursday (09/09): Foreign Bond Investment ¦ Foreign Investments in Japan Stocks

On Friday (09/10): Producer Price Index ¦ Machinery orders

On Tuesday (09/14): Industrial Production ¦ Capacity Utilization ¦ Industrial Production

On Wednesday (09/15): Tertiary Industry Index

On Thursday (09/16): Foreign Bond Investment ¦ Foreign Investments in Japan Stocks

On Monday (09/20): Merchandise Trade Balance ¦ Imports ¦ Exports

On Wednesday (09/22): BoJ Monetary Policy Statement ¦ BoJ Interest Rate Decision ¦ BoJ Press Conference

On Thursday (09/23): Foreign Bond Investment ¦ Foreign Investments in Japan Stocks

On Friday (09/24): National Consumer Price Index ¦ Jibun Bank Manufacturing PMI

On Monday (09/27): Corporate Service Price Index

On Tuesday (09/28): BoJ Monetary Policy Meeting Minutes

On Wednesday (09/29): Retail Trade ¦ Larger Retailer Sales

On Thursday (09/30): Industrial Production ¦ Foreign Bond Investment ¦ Foreign Investments in Japan Stocks ¦ Construction Orders ¦ Housing Starts

CAD

On Wednesday (09/01): Markit Manufacturing PMI

On Thursday (09/02): Imports ¦ International Merchandise Trade ¦ Building Permits ¦ Exports

On Friday (09/03): Labor Productivity

On Wednesday (09/08): Housing Starts ¦ Ivy Purchasing Managers Index ¦ BoC Rate Statement ¦ BoC Interest Rate Decision

On Friday (09/10): Capacity Utilization ¦ Unemployment Rate ¦ Participation Rate ¦ Average Hourly Wages ¦ Net Change in Employment

On Wednesday (09/15): Manufacturing Sales

On Thursday (09/16): ADP Employment Change

On Friday (09/17): Wholesale Sales

On Wednesday (09/22): BoC Consumer Price Index ¦ Consumer Price Index ¦ New Housing Price Index ¦ Consumer Price Index - Core

On Thursday (09/23): Employment Insurance Beneficiaries Change ¦ Retail Sales

On Thursday (09/20): Gross Domestic Product ¦ Raw Materials ¦ Industrial Production

MXN

On Wednesday (09/01): Remittances Total ¦ Central Bank Economist Survey ¦ Markit Mexico PMI ¦ IMEF Manufacturing Index ¦ IMEF Non-manufacturing Index

On Thursday (09/02): Vehicle Domestic Sales ¦ Consumer Confidence ¦ Leading Indicators

On Monday (09/06): Gross Fixed Investment ¦ Vehicle Exports ¦ Vehicle Production

On Tuesday (09/07): International Reserves Weekly ¦ Citibanamex Survey Economists

On Thursday (09/09): Consumer Price Index ¦ Consumer Price Index Core ¦ Bi-weekly CPI

On Friday (09/10): Industrial Production ¦ Manuf. Production ¦ Nominal Wages

On Sunday (09/12): Formal Job Creation

On Tuesday (09/14): International Reserves

On Monday (09/20): Aggregate Supply and Demand

On Thursday (09/23): Bi-weekly CPI

On Friday (09/24): Retail Sales ¦ BBG Mexico Economic Survey

On Monday (09/27): Economic Activity

On Tuesday (09/28): Unemployment Rate ¦ International Reserves Weekly

On Thursday (09/30): Net Outstanding Loan ¦ Overnight Rate ¦ Budget Balance

CNY

On Thursday (09/02): Caixin China PMI Composite ¦ Caixin China PMI Services

On Monday (09/06): Trade Balance ¦ Exports ¦ Imports ¦ Foreign Reserves

On Wednesday (09/08): Consumer Price Index ¦ Aggregate Financing ¦ New Yuan Loans ¦

On Thursday (09/09): Foreign Direct Investment YTD

On Wednesday (09/15): House Price Index ¦ Fixed Asset Investments ¦ NBS Press Conference ¦ Industrial Production ¦ Retail Sales

On Monday (09/20): PBoC Interest Rate Decision

On Thursday (09/30): Non Manufacturing PMIs ¦ NBS Manufacturing PMIS

BRL

On Wednesday (09/01): Gross Domestic Product ¦ Markit Manufacturing PMIs ¦ Trade Balance ¦ Exports ¦ Imports

On Thursday (09/02): Consumer Price Index FIPE ¦ Industrial Production

On Friday (09/03): Markit Composite PMI ¦ Markit Services PMIs

On Monday (09/06): Trade Balance

On Wednesday (09/08): FGV Inflation IGP-DI ¦ FGV Consumer Price Index IPC-s

On Thursday (09/09): IBGE Inflation IPCA

On Friday (09/10): FIPE Consumer Price Index Weekly ¦ Retail Sales

On Wednesday (09/15): Economic Activity

On Thursday (09/16): FGV Inflation IGP-DI ¦ FGV Consumer Price Index IPC-s

On Friday (09/17): FIPE CPI - weekly

On Monday (09/20): Tax Collection ¦ Trade Balance Weekly

On Wednesday (09/22): Selic Rate

On Thursday (09/23): FGV Consumer Price Index IPC-s

On Friday (09/24): Current Account Balance ¦ Foreign Direct Investment ¦ BBG Brazil Economic Survey ¦ Federal Debt Total

On Monday (09/27): FIPE CPI - Weekly ¦ Construction Costs ¦ Consumer Confidence ¦ Outstanding Loans ¦ Personal Loan default rate

On Wednesday (09/29): PPI Manufacturing ¦ Primary budget Balance ¦ Nominal Budget Balance ¦ Net Debt % GDP

On Thursday (09/30): Inflation IGPM ¦ National Unemployment Rate ¦ Central Government Budget Balance

If you would like to receive our daily and monthly reports on global currencies straight into your inbox, subscribe today.