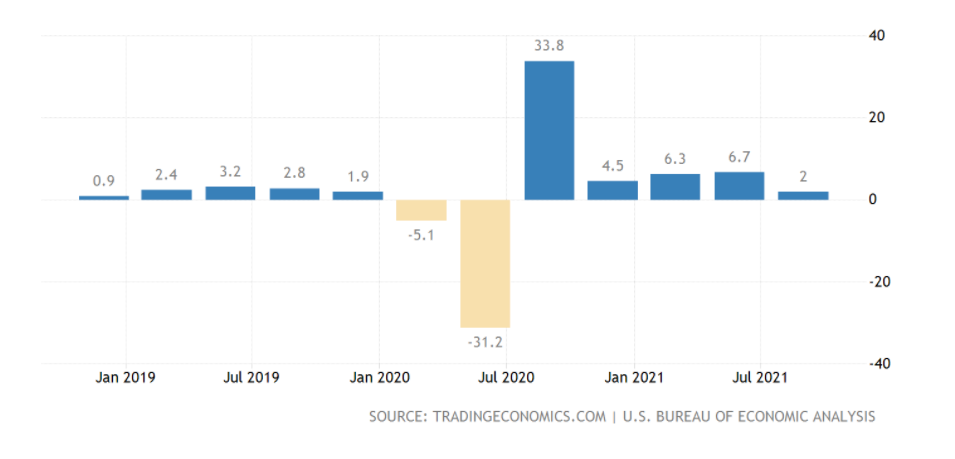

The Federal Reserve is playing a dangerous game in their ability to ignore and constantly undermine high sustained inflation, referring to such price behaviour as transitory. Policymakers are now navigating between their own senses of patience and risk, on top of having to deal with a U.S. economy stymied by disrupted supply chains, slow hiring, weaker consumer demand and poor Q3 Gross Domestic Product (GDP) readings, raising concerns over the Fed’s next move. The U.S. GDP, which measures the value of goods and services produced by the economy, grew two percent in the third quarter on an annualized basis, failing to impress market participants, amid expectations set at 2.7% and previous results of 6.7% in June. The slower growth was attributed to the latest wave of covid-19 cases, sustained supply chain bottlenecks, surging inflation and ebbing federal financial lifelines, downshifting the pace of the economic recovery from the pandemic.

U.S. Gross Domestic Product Quarterly

Policymakers raised significant concerns around the sharp slowdown in consumer spending, which was one of the reasons behind the disappointing growth figures during this quarter. Personal consumption grew scant at 1.6% year over year in Q3, compared with a 12% growth achieved in Q2 this year. The deadly Delta variant kept consumers cautious during the course of the quarter, while supply chain constraints and shortages in raw material drove prices higher for businesses, many of which passed them on to consumers. However, it is worth mentioning that back in August, the combination of supply bottlenecks and a surge in household incomes fueled by pandemic-related government aid, pushed the personal consumption expenditure price index, a key measure of inflation, to a high 30-year high on an annualized basis.

Personal Consumption Expenditure price index

Randal Quarles, Fed Governor, said last week that the fundamental dilemma that policymakers face is that demand, augmented by unprecedented fiscal stimulus, has been outstripping temporarily disrupted supply. Yet, the economy’s fundamental capacity remains intact and Fed officials want to keep interest rates low for as long as possible to let employment rise. The latest unemployment figures showed that in September, only 194k new jobs were created, far below the 500k market participants were expecting. However, August figures were revised up from 235k to 366k, which netted out by reducing the unemployment rate from 5.1% to 4.8%. The significant slowdown in hiring pace keeps policymakers awake at night, as withdrawing stimulus would mean that job creation will start being more challenging as conditions tighten.

S&P 500 Index | Source: Trading View

However, to close out the month, Personal Consumption Expenditures (PCE) Price Index, a favourite gauge of inflation for U.S. policymakers, gave a breath of fresh air as readings came in softer than anticipated, posting 4.4% annualized vs 4.7% previously anticipated. Core readings also came in line with softer inflation, posting 3.6% vs 3.7% expected, suggesting that inflation is sustained. This gives room for policymakers to start tapering its bond purchase programme, although they still have the issue of lagging unemployment.

The dollar spiked over 1% against most of its peers soon after the Commerce Department released PCE Index readings, which bolstered the demand for dollars amid hawkish expectations from the Federal Reserve. However, the greenback remained subdued against most of its peers during the course of the month, with severe losses after Gross Domestic Product readings shook markets with a poor 2%, inducing fears of stagflation.

The greenback remained subdued against most of its peers during the course of the month, with severe losses after Gross Domestic Product readings shook markets with a poor 2%. The U.S. dollar index, which tracks the performance of the greenback against a basket of six major currencies, fell 0.6% after the announcement and is looking to close 1.34% lower from the monthly highs, at levels last seen in October 2020. However, stocks continue to reach new all-time highs, with S&P hitting 4,569 and looking to close the month with strong momentum to break over once more. Fed officials also start to feel pressure from other central banks which have already started their tightening cycle. The Bank of Canada, announced earlier this week its decision to leave interest rates unchanged and put an end to its Quantitative Easing program, highlighting that rate hikes might come sooner than previously anticipated. On the other hand, the Bank of England is a solid candidate to be the first major Central Bank to hike rates in the post-pandemic recovery. However, friction arising from Brexit keeps the French and British sour amid sustained threats regarding fishing rights.

U.S. Dollar Index

The Fed will be meeting next week, and a disappointing response from policymakers could trigger a major weakness for the greenback. The Federal Open Market Committee (FOMC) is expected to announce plans to phase out its 120 billion in monthly asset purchases by the middle of 2022. Between now and next summer, the path of inflation, inflation expectations, and job growth will determine whether the central bank hastens the date of lifting its target interest rate from its current near-zero level. However, amid the recent poor growth figures, policymakers will have to make a decision to initiate the withdrawal of stimulus, without having a peek at Job reports, which are due to be released two days after and expected to create 385k new jobs. If the FOMC takes a hawkish approach and job reports raise the alarm, unemployment will most likely linger, crippling the economic recovery. On the other hand, if the committee takes a dovish stance and job reports smash it out of the court, we might see accentuated inflationary pressures and may overheat the economy.

November’s Economic Calendar

USD

On Monday 11/01: ISM Manufacturing PMI ¦ ISM Manufacturing New orders ¦ Construction Spending ¦ Markit Manufacturing PMI

On Tuesday 11/02: Redbook Index ¦ Total Vehicle Sales

On Wednesday 11/03: ADP Employment Change ¦ Markit Services PMI ¦ Markit PMI Composite ¦ ISM Services PMI ¦ ISM Services Employment Index ¦ Factory Orders ¦ Fed Interest Rate Decision ¦ Fed’s Monetary Policy Statement ¦ FOMC Press Conference

On Thursday 11/04: OPEC Meeting ¦ Goods and Services Trade Balance ¦ Nonfarm Productivity ¦ Initial Jobless Claims ¦ Unit Labor Cost ¦ Initial Jobless Claims

On Friday 11/05: Nonfarm Payrolls ¦ Average Hourly Earnings ¦ Labor Force Participation Rate ¦ U6 Underemployment rate ¦ Unemployment Rate

On Sunday 11/07: Daylight Saving Time Ends

On Tuesday 11/09: Producer Price Index ¦ Redbook Index

On Wednesday 11/10: Consumer Price Index ¦ Consumer Price Index Core ¦ Continuing Jobless Claims ¦ Initial Jobless Claims Wholesale Inventories

On Thursday 11/11: Veterans Day

On Friday 11/12: Michigan Consumer Sentiment Index

On Tuesday 11/16: Industrial Production ¦ Import Price Index ¦ Export Price Index ¦ Capacity Utilization ¦ Business Inventories

On Wednesday 11/17: Retail Sales ¦ Building Permits ¦ Housing Starts

On Thursday 11/18: Continuing Jobless Claims ¦ Philadelphia Fed Manufacturing Survey ¦ Initial Jobless Claims

On Tuesday 11/24: Personal Consumption Expenditure ¦ Core Personal Consumption Expenditures ¦ Wholesale Inventories ¦ Personal Income ¦ Good Trade Balance ¦ Personal Spending ¦ Michigan Consumer Sentiment ¦ FOMC Minutes

On Thursday 11/25: Thanksgiving day ¦ Initial Jobless Claims

On Friday 11/26: Durable Good Orders ¦ Nondefense Goods orders

On Monday 11/29: Pending Home Sales

On Tuesday 11/30: Gross Domestic Product ¦ Redbook Index ¦ Housing Price Index ¦ Chicago Purchasing Managers Index ¦ Consumer Confidence

EUR

On Tuesday 11/02: Markit Manufacturing PMI

On Wednesday 11/03: Unemployment Rate

On Thursday 11/04: Markit Services PMI ¦ European Commission releases Economic Growth Forecasts ¦ Markit PMI Composite ¦ Producer Price Index

On Friday 11/05: Retail Sales

On Monday 11/08: Eurogroup Meeting

On Tuesday 11/09: EcoFin Meeting ¦ ZEW Survey - Economic Sentiment

On Thursday 11/11: Economic Bulletin

On Friday 11/12: EcoFin Meeting ¦ Industrial Production

On Sunday 11/14: Gross Domestic Product

On Monday 11/15: Trade Balance

On Tuesday 11/16: Employment Change ¦ Gross Domestic Product ¦ Employment Change

On Wednesday 11/17: EU Financial Stability Review ¦ Construction Output

On Thursday 11/18: Consumer Price Index

On Friday 11/19: Current Account

On Monday 11/22: Consumer Confidence

On Tuesday 11.23: Markit Manufacturing PMI ¦ Markit Services PMI ¦ Markit PMI Composite

On Friday 11/26: Private Loans ¦ M3 Money Supply

On Monday 11/29: Services Sentiment ¦ Consumer Confidence ¦ Industrial Confidence ¦ Business Climate ¦ Economic Sentiment Indicator

On Tuesday 11/30: Consumer Price Index

GBP

On Monday 11/01: Markit Manufacturing PMI

On Wednesday 11/03: Nationwide Housing Price ¦ Markit Services PMI

On Thursday 11/04: Bank of England Monetary Policy Report ¦ BoE MPC Vote Rate Unchanged ¦ BoE Asset Purchase Facility ¦ Monetary Policy Summary ¦ BoE MPC Vote Count ¦ Bank of England Minutes ¦ BoE Interest Rate Decision ¦ BoE Governor Bailey Speech

On Friday 11/05: Halifax House Prices

On Tuesday 11/09: BORC Like-For-Like Retail Sales

On Thursday 11/11: Manufacturing Production ¦ Industrial Production ¦ Gross Domestic Product ¦ Total Trade Balance ¦ Total Business Investment

On Tuesday 11/16: Claimant Count Rate ¦ ILO Unemployment Rate ¦ Average Earnings including Bonus/excluding bonus

On Wednesday 11/17: Consumer Price Index ¦ Retail Price Index ¦ PPI Core Output ¦ Core Consumer Price Index ¦ Producer Price Index

On Friday 11/19: GfK Consumer Confidence ¦ Retail Sales ex-fuel ¦ Retail Sales ¦ Public Sector Net Borrowings

On Tuesday 11/23: Markit Manufacturing PMI ¦ Markit Services PMI ¦

On Wednesday 11/24: Autumn Forecast Statement

On Monday 11/29: Consumer Credit ¦ Mortgage Approvals

On Tuesday 11/30: Nationwide Housing Prices ¦ Net Lending to individuals

JPY

On Monday 11/01: Jibun Bank Manufacturing PMI

On Tuesday 11/02: BoJ Monetary Policy Meeting Minutes ¦ Monetary Base ¦ Culture Day

On Thursday 11/04: Jibun Bank Services PMI

On Friday 11/05: Overall Household Spending

On Monday 11/08: JP Foreign Reserves ¦ BoJ Summary of Opinions ¦ Coincident Index ¦ Leading Economic Sentiment ¦ Machine Tool Orders

On Tuesday 11/09: Labor Cash Earnings ¦ Current Account ¦ Bank Lending ¦ Trade Balance - BOP Basis ¦ Eco Watchers Survey: Outlook/Current

On Thursday 11/11: Producer Price Index ¦

On Monday 11/15: Gross Domestic Product ¦ Industrial Production ¦ Capacity Utilization ¦ Industrial Production

On Tuesday 11/16: Tertiary Industry Index

On wednesday 11/17: Machinery Orders

On Friday 11/19: National Consumer Price Index ex-food, energy ¦ National Consumer Price Index ¦ Adjusted Merchandise Trade Balance ¦ Imports ¦ Exports

On Monday 11/22: Labor Thanksgiving Day

On Monday 11/23: Jibun Bank Manufacturing PMI

On Thursday 11/25: Corporate Service Price Index ¦ Coincident Index ¦ Leading Economic Sentiment

On Friday 11/26: Tokyo Consumer Price Index

On Monday 11/29: Consumer Confidence Index

On Tuesday 11/30: Job / Applicants Ratio ¦ Unemployment Rate ¦ Retail Trade ¦ Industrial Production ¦ Large Retailer Sales ¦ Industrial Production ¦ Constructions Orders ¦ Housing Starts ¦ Consumer Confidence Index

CAD

On Monday 11/01: Markit Manufacturing PMI

On Tuesday 11/02: Building Permits

On Thursday 11/04: Imports ¦ Exports ¦ International Merchandise Trade

On Friday 11/05: Unemployment Rate ¦ Participation Rate ¦ Average Hourly Wages ¦ Net Change in Employment ¦ Ivey Purchasing Managers Index

On Tuesday 11/09: BoC Beaudry Speech ¦ BoC Governor Macklem Speech

On Thursday 11/11: Remembrance Day

On Tuesday 11/16: Housing Starts ¦ Manufacturing Sales

On Wednesday 11/17: BoC Consumer Price Index ¦ Consumer Price Index

On Thursday 11/18: Wholesale Sales ¦ ADP Employment Change ¦ Employment Insurance Beneficiaries ¦ New Housing Price Index

On Friday 11/19: Retail Sales

On Monday 11/29: Current Account

On Tuesday 11/30: Raw Materials Price Index ¦ Gross Domestic Product ¦ Industrial Product Price

CNY

On Monday 11/01: Caixin Manufacturing PMI

On Wednesday 11/03: Caixin Services PMI

On Sunday 11/07: Exports ¦ Imports ¦ Trade Balance ¦ Foreign Exchange Reserves

On Wednesday 11/10: Consumer Price Index ¦ Producer Price Index ¦ Foreign Direct Investments ¦ New Loans ¦ M2 Money Supply

On Monday 11/15: House Price Index ¦ Fixed Assets Investments ¦ NBS Press Conference ¦ Industrial Production ¦ Retail Sales

On Monday 11/22: PBoC Interest Rate Decision

On Tuesday 11/30: Non-Manufacturing PMI ¦ NBS Manufacturing PMI

BRL

On Monday 11/01: All Saints’ Day ¦ HSBC PMI Manufacturing ¦ Trade Balance

On Tuesday 11/02: All Souls Day

On Wednesday 11/03: Fipe’s IPC Inflation

On Thursday 11/04: Industrial Output

On Wednesday 11/10: IPCA Inflation

On Thursday 11/11: Retail Sales

On Monday 11/15: Republic Day

On Saturday 11/20: Zumbi dos Palmares

On Thursday 11/25: Current Account ¦ Mid-month Inflation

On Monday 11/29: Inflation Index / IGP-M

On Tuesday 11/30: Unemployment Rate ¦ Primary Budget Surplus ¦ Nominal Budget Surplus

MXN

On Tuesday 11/02: Day of the dead

On Friday 11/05: Consumer Confidence

On Tuesday 11/09: 12 Month Inflation ¦ Core Inflation ¦ Headline Inflation

On Thursday 11/11: Industrial Output ¦ Central Bank Interest Rate

On Monday 11/15: Revolution Day

On Tuesday 11/23: Retail Sales

On Wednesday 11/24: 1st Half month Core Inflation

On Thursday 11/25: Gross Domestic Product

On Friday 11/26: Trade Balance

On Monday 11/29: Jobless Rate

On Tuesday 11/30: Fiscal Balance

If you have any questions, feel free to contact us and speak to an expert today.